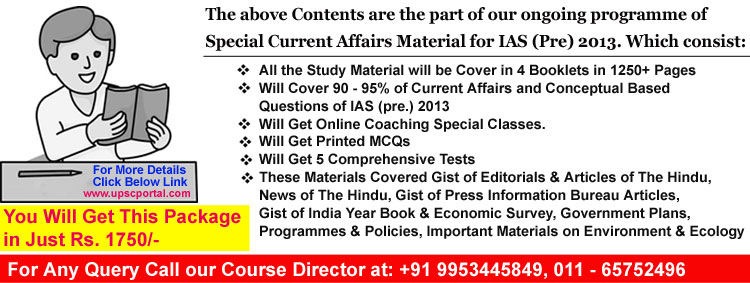

(IGP) Special Current Affairs Material for IAS (Pre) 2013 - PIB "Topic:Empowering The Workers"

(IGP) Special Current Affairs Material for IAS (Pre) 2013

Chapter: Gist of Press Information Bureau Articles

Topic: Empowering The Workers

Q. What are the main features of Rashtriya Swasthya Bima Yojana (RSBY)?

- The ‘Rashtriya Swasthya Bima Yojana’ providing for smart card based cashless health insurance cover of Rs.30000/- per annum on a family floater basis to BPL families (a unit of five) in the unorganized sector, was formally launched on October, 1, 2007 and became operational from April 1, 2008.

- It covers of all pre-existing diseases and hospitalisation expenses, including maternity benefit, plus payment of transportation cost of Rs.100/- per visit.

- As per the salient features of the scheme the Government contributes 75% of the annual premium. State Governments contribute 25%. In case of North-East region and Jammu & Kashmir, the premium is shared in the ratio of 90:10; the beneficiary family pays Rs. 30 per annum per family as registration or renewal fee.

- The Scheme is being implemented in 24 States/Union Territories and more than 2.57 crore smart cards have been issued.

Q. Which types of other workers also have been covered under Rashtriya Swasthya Bima Yojana?

Rashtriya Swasthya Bima Yojana has also been extended to building and other construction workers registered under the Building and other Construction Workers (Regulation of Employment and Condition of Service) Act, 1996 and street vendors, beedi workers, MGNREGA beneficiaries (who have worked for more than 15 days during the preceding financial year and domestic workers.

Q. What do you know about Employees State Insurance (ESI) Scheme?

-

The promulgation of Employees’ State Insurance Act, by the Parliament, in 1948, was the first comprehensive Social Security legislation in independent India.

-

The Act envisages social protection for workers in the organised sector in contingencies, such as sickness, maternity, disablement and death due to employment injury.

-

Besides, adequate cash compensation to insured persons for loss of wages or earning capacity in times of physical distress arising out of sickness or employment injury is also provided. Under the scheme medical care is also provided to families of the insured persons.

-

The ESI Act applies to non-seasonal factories employing 10 or more persons. The provisions of the Act are being brought into force area-wise in stages.

-

The Act contains an enabling provision under which the “appropriate government” is empowered to extend the provisions of the Act to other classes of establishments- industrial, commercial, agricultural or otherwise.

-

Under these provisions, the State Governments have extended the provisions of the Act to shops, hotels, restaurants, cinemas including preview theatres, road motor transport undertakings, newspaper establishments, educational and medical institutions employing 20 or more employees.

-

Thirteen State governments have reduced the threshold for coverage of shops and establishments to 10 or more persons. Employees of factories and establishments covered under the Act drawing monthly wages upto Rs.15, 000/- per month are covered under the Scheme. Under the Act, the employers are required to pay contribution at the rate of 4.75 percent of wages of the covered employees.

-

The rate of contribution for the employees is 1.75 percent of their wages. Low paid workers drawing wages upto Rs.100/- per day are exempted from paying their share of contribution. However, the employers are required to pay their share of contribution. The State Governments bear 1/8th of the expenditure on medical care.

-

Cash benefits are provided through a network of 610 Branch Offices and 187 Pay Offices. In addition, 374 Inspection Offices are functioning under 23 Regional Offices, 26 Sub-Regional Offices and 2 Divisional Offices.

-

As per the provision of Section 58 of the ESI Act, State Government is the designated agency for delivery and administering medical care to the beneficiaries except for Delhi, Noida and Model Hospitals wherein ESIC is directly providing medical services. For providing a uniform level of medical care, the Corporation, as per the provisions of Section 58(3) of the Act, enters into agreement with the State Governments and the expenditure on medical care is reimbursed within the prescribed ceiling which is presently Rs.1200/- per IP family unit per annum w.e.f. 01.04.2008.

-

The delivery of medical care is through a service (direct) as well as a panel (indirect) system. The direct system functions through a network of Hospitals (146), annexes (42), dispensaries (1402), ISM Units (93). A total of 1447 panel doctors were engaged in providing primary medical services through the indirect system.

Q. What are the main features of government’s Skill Development Initiative (SDI) Scheme?

-

In pursuance of excellence in vocational training, a new strategic framework for skill development for early school leavers and existing workers has been developed since May, 2007 in close consultation with industry, State Governments and experts.

-

The Scheme offers multi- entry and multi-exit options, flexible delivery schedule and lifelong learning. Modular Employable Skills (MES) Framework envisaged under this Scheme involves the ‘minimum skills set’ which is sufficient for gainful employment. Emphasis in the curricula is also on soft skills.

-

Courses are also available for persons having completed 5th standard and attained the age of 14 years. Central government is facilitating and promoting training while industry, private sector and State Governments are associated with training the persons through Vocational Training Providers.

-

At present, 1386 Modules for employable skills covering 60 sectors have been developed, 36 Assessing Bodies empanelled for conducting assessment, 6,753 Vocational Training Providers (VTPs) have been registered and more than 12.19 lakh persons have been trained.

Go

Back To Main Page

Go

Back To Main Page