(IGP) Special Current Affairs Material for IAS (Pre) 2013 - PIB "Topic: External Debt: Definitions And Concepts"

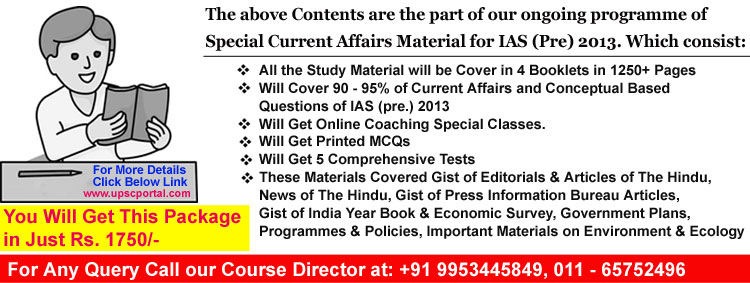

(IGP) Special Current Affairs Material for IAS (Pre) 2013

Chapter: Gist of Press Information Bureau Articles

Topic: External Debt: Definitions And Concepts

Q. What you understand by ‘External Debt’?

Gross external debt, at a point in time, is defined as the outstanding amount of those actual current, and not contingent, liabilities that require payment(s) of principal and/or interest by the debtor at some point(s) in the future and that are owed to non-residents by residents of an economy.Q. What you know about Original and Residual Maturity of External Debt?

Original maturity is defined as the period encompassing the precise time of

creation of the financial liability to its date of final maturity.

Debt by residual maturity (or remaining maturity) includes short term debt by

original maturity of up to one year, combined with medium to long term debt

repayment by original maturity falling due within the twelve month period

following a reference date. External debt is commonly expressed in terms of

original maturity.

Q. What is the classification of External Debt as Long and Short-term?

One way of classifying external debt is into long and

short-term. Long term debt is defined as debt with an original maturity of more

than one year, while short term debt is defined as debt repayments on demand or

with an original maturity of one year or less.

The coverage of short-term was redefined from 2005-06 by including supplier’s

credit upto 180 days and FII investment in the Government Treasury Bills and

other instruments and further in March 2007 by including external debt

liabilities of the banking system and the investment in the Government

securities by the foreign central banks and the international institutions.

Q. Multilateral and Bilateral External Debt?

-

Multilateral creditors are primarily multilateral institutions such as the International Development Association (IDA), International Bank for Reconstruction and Development (IBRD), Asian Development bank (ADB) etc.

-

Bilateral creditors are sovereign countries with whom sovereign and non-sovereign entities enter into one-to-one loan arrangements. Some of India’s bilateral creditors who extend loans to both sovereign and non-sovereign debtors include Japan, Germany, United States, France, Netherlands, Russian Federation etc.

Q. What is the difference between Sovereign (Government) and Non-Sovereign (Non-Government) debt?

Sovereign debt includes (i) external debt outstanding on account of loans received by Government of India under the ‘external assistance’ programme, and civilian component of Rupee Debt; (ii) other Government debt comprising borrowings from IMF, defence debt component of Rupee debt as well as foreign currency defence debt and (iii) FII investment in Government Securities. Non-sovereign includes the remaining components of external debt.

Q. What do you mean by External Commercial Borrowings?

The definition of commercial borrowing includes loans from commercial banks, other commercial financial institutions, money raised through issue of securitized instruments like Bonds (including India Development Bonds (IDBs) and Resurgent India Bonds (RIBs), Floating Rate Notes (FRN) etc. It also includes borrowings through Buyers’ credit & Supplier credit mechanism of the concerned countries, International Finance Corporation, Washington [IFC (W)], Nordic Investment Bank and private sector borrowings from Asian Development Bank (ADB).Q. There are how many types of NRI Deposits?

Non-Resident Indian (NRI) deposits are of three types:

- Non Resident (External) Rupee Account {NR (E) RA} Deposits were introduced in 1970. Any NRI can open an NRE account with funds remitted to India through a bank abroad. A NRE account maintained in Indian rupee may be opened as current, savings or term deposit. The amount held in these deposits together with the interest accrued can be repatriated.

- Foreign Currency Non Resident (Banks) Deposits {FCNR (B)} were introduced with effect from May 15, 1993. These are term deposits maintained only in Pound Sterling, U.S. dollar, Japanese Yen, Euro, Canadian dollar and Australian dollar. The minimum maturity period of these deposits was raised from six months to 1 year effective October 1999. From July 26, 2005, banks have been allowed to accept FCNR (B) deposits up to a maximum maturity period of five years against the earlier maximum limit of three years.

- Non-Resident Ordinary Rupee (NRO) Accounts – Any person residing outside India may open and maintain NRO account with an Authorised dealer or in authorised bank for the purpose of putting through bonafide transactions denominated in Indian Rupee. NRO Accounts may be opened/maintained in the form of current, saving, recurring or fixed deposits. NRI/Persons of Indian Origin (PIO) may remit an amount not exceeding USD 1 million per financial year out of the balances held in NRO Accounts.

Q. What is Concessional Debt?

Generally, a loan is defined as ‘concessional’ when it carries a grant element of 25 per cent or more. In India, loans from multilateral (the International Development Association (IDA), International Fund for Agricultural Development (IFAD)) and bilateral sources (including rupee debt that is serviced through exports) is categorized as ‘concessional’, based long maturity and less-than-market rates of interest charged on them.

Q. How Debt Service Ratio is measured?

Debt service ratio is measured by the proportion of total debt service payments (i.e. principal repayment plus interest payment) to current receipts (minus official transfers) of Balance of Payments (BoP). It indicates the claim that servicing of external debt makes on current receipts and is, therefore, a measure of strain on BoP due to servicing of debt service obligations.

Go

Back To Main Page

Go

Back To Main Page