(IGP) Special Current Affairs Material for IAS (Pre) 2013 - PIB "Topic: Public Expenditure Reforms"

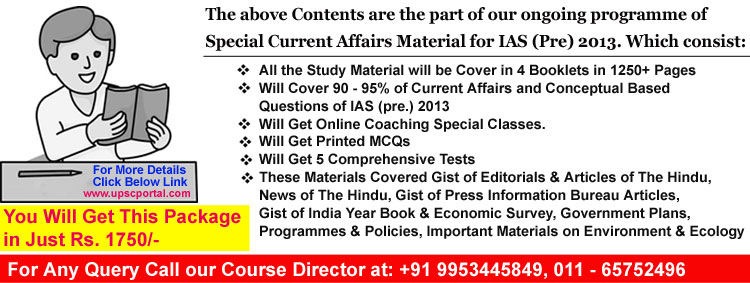

(IGP) Special Current Affairs Material for IAS (Pre) 2013

Chapter: Gist of Press Information Bureau Articles

Topic: Public Expenditure Reforms

Q. How Public Expenditure is governed in India?

- Public Expenditure in the Government is managed as per the Appropriation Act which is passed by the Parliament every year.

- Based on the estimates of expenditure as presented in the Annual Financial Statement, Demands for Grants are presented for the approval of the Parliament.

- Thereafter, Ministries/Departments seek the approval of Parliament on their respective Detailed Demands for Grants (DDG) that gives service wise estimates of expenditure.

- During the financial year, expenditures are incurred in accordance with the estimates approved in the DDGs.

- For the formulation of these estimates to be presented in the Budget, extensive consultations are held with the respective departments/ministries in meetings chaired by Secretary (Expenditure) in which the Internal Financial Units of the respective ministry/ department, headed by the Financial Advisers and the functional heads in the ministries/ departments participate.

Q. What the actions are being taken by government to bring down its fiscal deficit?

- The Central Government has embarked upon a fiscal consolidation programme to bring down its fiscal deficit over a period of time. With the reduction of the fiscal deficit, it is expected that the debt stock of Government would stabilize within acceptable limits. This would further reduce the interest payments that Government has to incur every year, thereby freeing more resources for development spending.

- The expenditure of Central Government comprises of certain committed items like salaries, pension, interest payments, Defence etc.

Q. What are the action/ suggestions of different bodies/ commissions for fiscal consolidation?

-

13th Finance Commission (FC) recommended that awards of Pay Commissions should be made to commence from the date on which the recommendations of future Pay Commissions are accepted by the Government.

-

The three major subsidies provided by Central Government are Food, Fertilizer and Petroleum Subsidies. A High Level Expert Committee (HLEC) under the Chairmanship of Dr. C. Rangarajan has made recommendations on fundamental aspects of public finance that are under consideration. The Budget of Central Government is a statement of fiscal allocations and has no disclosures on the corresponding outcomes achieved.

-

Outcome Budget was started in Government consequent to the announcement of the Finance Minister in the budget speech for 2005-06. Detailed guidelines for the Outcome Budget presented by every Ministry in respect of every demand, except those explicitly exempted from doing so, for plan as well as non plan expenditure, are issued by Department of Expenditure every year.

-

The Performance Monitoring and Evaluation System (PMES) is a system of performing management and reporting which was started from the year 2009-10. Under PMES, each department is required to prepare a Results-Framework Document (RFD). RFD provides a summary of the most important results that a department/ministry expects to achieve during the financial year.

-

This document has two main purposes: (i) move the focus of the department from process-orientation to results-orientation, and (ii) provide an objective and fair basis to evaluate department’s overall performance at the end of the year.

Q. What is the description of Plan expenditure of the Government?

- The Plan expenditure of the Government can be divided into Central Plan and Assistance to State Plans. Central Plan consists of Central Plan Schemes and Centrally Sponsored Schemes (CSS) that are implemented by States.

- There is a need to rationalize schemes within a Ministry and across Ministries. Rationalization of both plan and non plan schemes would require dropping of schemes which have out lived their utility, while taking up new schemes.

- Towards this objective, Cabinet, in November 2010 has approved setting up of an Independent Evaluation Office attached to the Planning Commission. The Comptroller and Auditor General of India also conducts performance audit of the activities of the Government, which analyses the aspects of economy, efficiency and effectiveness of Government activities.

- Monitoring and evaluation also includes monitoring the trend and pace of expenditure on schemes. The Central Plan Scheme Monitoring System (CPSMS), which provides real time information on the status of plan schemes of the Government, is an important initiative in this regard. There is a need to strengthen this system to provide more information on expenditure and utilization under plan schemes.

Go

Back To Main Page

Go

Back To Main Page