Mind Map for UPSC Exam (Foreign Contribution (Regulation) Act)

Mind Map for UPSC Exam (Foreign Contribution (Regulation) Act)

Click Here to Download Full MAP in PDF

Study Material for IAS Prelims: GS Paper -1 + CSAT Paper-2

Online Crash Course for UPSC PRE Exam

Mind Map Important Topics:

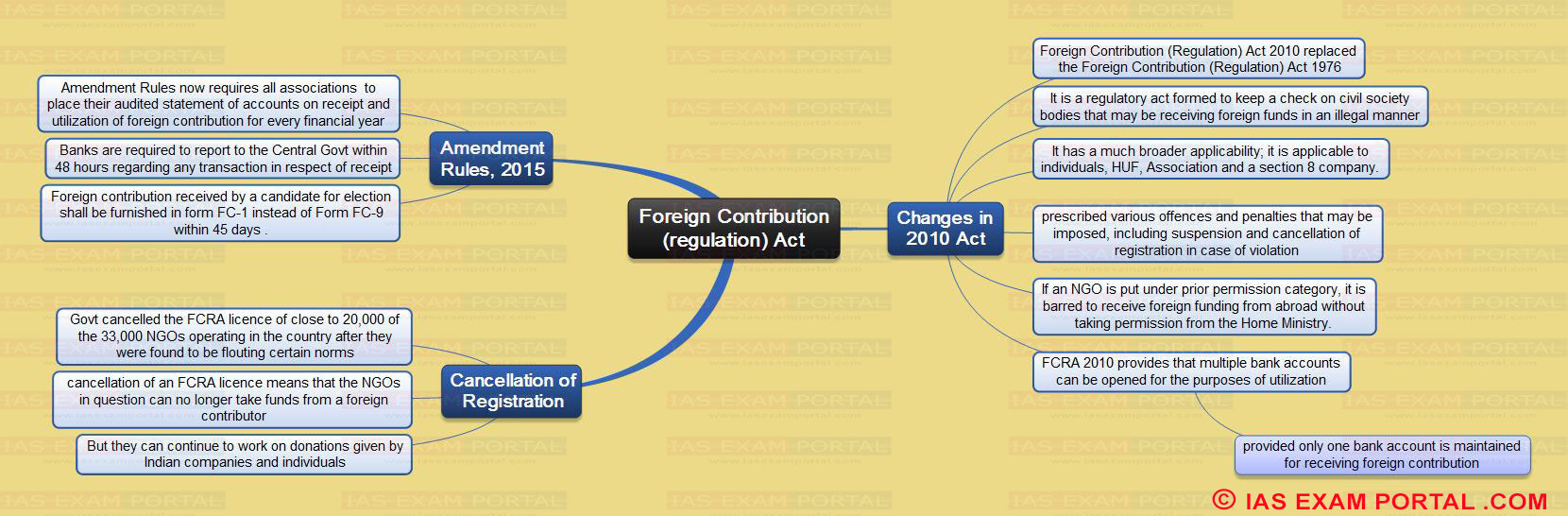

Foreign Contribution (Regulation) Act

Amendment Rules, 2015

- Amendment Rules now requires all associations to place their audited statement of accounts on receipt and utilization of foreign contribution for every financial year

- Banks are required to report to the Central Govt within 48 hours regarding any transaction in respect of receipt

- Foreign contribution received by a candidate for election shall be furnished in form FC-1 instead of Form FC-9 within 45 days .

Cancellation of Registration

- Govt cancelled the FCRA licence of close to 20,000 of the 33,000 NGOs operating in the country after they were found to be flouting certain norms

- cancellation of an FCRA licence means that the NGOs in question can no longer take funds from a foreign contributor

- But they can continue to work on donations given by Indian companies and individuals

Changes in 2010 Act

- Foreign Contribution (Regulation) Act 2010 replaced the Foreign Contribution (Regulation) Act 1976

- It is a regulatory act formed to keep a check on civil society bodies that may be receiving foreign funds in an illegal manner

- It has a much broader applicability; it is applicable to individuals, HUF, Association and a section 8 company.

- prescribed various offences and penalties that may be imposed, including suspension and cancellation of registration in case of violation

- If an NGO is put under prior permission category, it is barred to receive foreign funding from abroad without taking permission from the Home Ministry.

- FCRA 2010 provides that multiple bank accounts can be opened for the purposes of utilization

- provided only one bank account is maintained for receiving foreign contribution