(HOT) UPSC Current Affairs 2025 PDF

NEW! The Gist (NOV-2025) | E-BOOKS

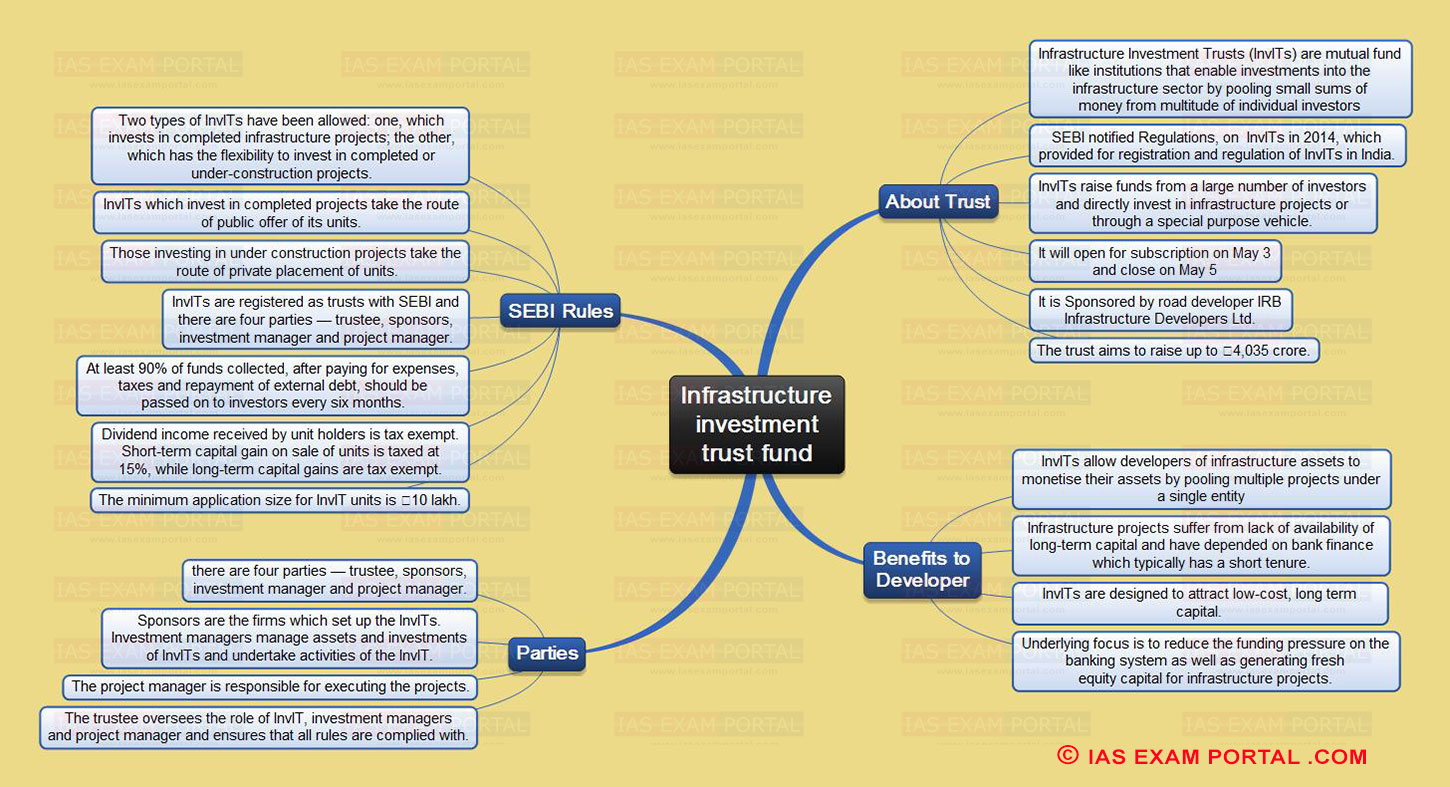

Infrastructure Investment Trust Fund: Mind Map for UPSC Exam

Infrastructure Investment Trust Fund: Mind Map for UPSC Exam

Click Here to Download Full MAP in PDF

Study Material for IAS Prelims: GS Paper -1 + CSAT Paper-2

Online Crash Course for UPSC PRE Exam

Mind Map Important Topics:

Infrastructure Investment Trust Fund

About Trust

- Infrastructure Investment Trusts (InvITs) are mutual fund like institutions that enable investments into the infrastructure sector by pooling small sums of money from multitude of individual investors

- SEBI notified Regulations, on InvITs in 2014, which provided for registration and regulation of InvITs in India.

- InvITs raise funds from a large number of investors and directly invest in infrastructure projects or through a special purpose vehicle.

- It will open for subscription on May 3 and close on May 5

- It is Sponsored by road developer IRB Infrastructure Developers Ltd.

- The trust aims to raise up to ₹4,035 crore.

SEBI Rules

- Two types of InvITs have been allowed: one, which invests in completed infrastructure projects; the other, which has the flexibility to invest in completed or under-construction projects.

- InvITs which invest in completed projects take the route of public offer of its units.

- Those investing in under construction projects take the route of private placement of units.

- InvITs are registered as trusts with SEBI and there are four parties — trustee, sponsors, investment manager and project manager.

- At least 90% of funds collected, after paying for expenses, taxes and repayment of external debt, should be passed on to investors every six months.

- Dividend income received by unit holders is tax exempt. Short-term capital gain on sale of units is taxed at 15%, while long-term capital gains are tax exempt.

- The minimum application size for InvIT units is Rs. 10 lakh.

Benefits to Developer

- InvITs allow developers of infrastructure assets to monetise their assets by pooling multiple projects under a single entity

- Infrastructure projects suffer from lack of availability of long-term capital and have depended on bank finance which typically has a short tenure.

- InvITs are designed to attract low-cost, long term capital.

- Underlying focus is to reduce the funding pressure on the banking system as well as generating fresh equity capital for infrastructure projects.

Parties

- There are four parties — trustee, sponsors, investment manager and project manager.

- Sponsors are the firms which set up the InvITs. Investment managers manage assets and investments of InvITs and undertake activities of the InvIT.

- The project manager is responsible for executing the projects.

- The trustee oversees the role of InvIT, investment managers and project manager and ensures that all rules are complied with.