Mind Map for UPSC Exam (Goods and Services Tax - GST)

Mind Map for UPSC Exam (Goods and Services Tax - GST)

Click Here to Download Full MAP in PDF

Study Material for IAS Prelims: GS Paper -1 + CSAT Paper-2

Online Crash Course for UPSC PRE Exam

Mind Map Important Topics:

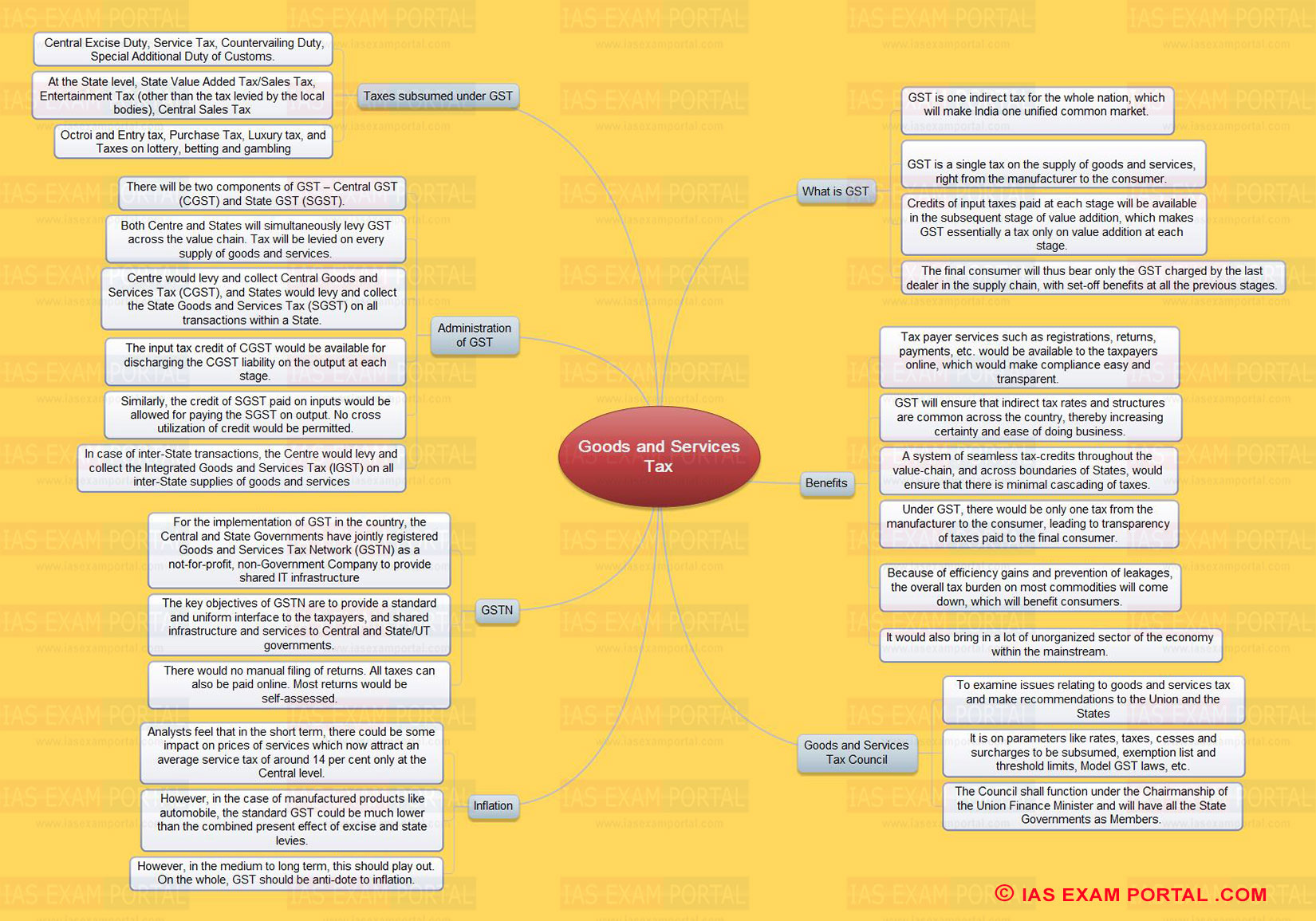

Goods and Services Tax

What is GST

- GST is one indirect tax for the whole nation, which will make India one unified common market.

- GST is a single tax on the supply of goods and services, right from the manufacturer to the consumer.

- Credits of input taxes paid at each stage will be available in the subsequent stage of value addition, which makes GST essentially a tax only on value addition at each stage.

- The final consumer will thus bear only the GST charged by the last dealer in the supply chain, with set-off benefits at all the previous stages.

Benefits

- Tax payer services such as registrations, returns, payments, etc. would be available to the taxpayers online, which would make compliance easy and transparent.

- GST will ensure that indirect tax rates and structures are common across the country, thereby increasing certainty and ease of doing business.

- A system of seamless tax-credits throughout the value-chain, and across boundaries of States, would ensure that there is minimal cascading of taxes.

- Under GST, there would be only one tax from the manufacturer to the consumer, leading to transparency of taxes paid to the final consumer.

- Because of efficiency gains and prevention of leakages, the overall tax burden on most commodities will come down, which will benefit consumers.

- It would also bring in a lot of unorganized sector of the economy within the mainstream.

Goods and Services Tax Council

- To examine issues relating to goods and services tax and make recommendations to the Union and the States

- It is on parameters like rates, taxes, cesses and surcharges to be subsumed, exemption list and threshold limits, Model GST laws, etc.

- The Council shall function under the Chairmanship of the Union Finance Minister and will have all the State Governments as Members.

Taxes subsumed under GST

- Central Excise Duty, Service Tax, Countervailing Duty, Special Additional Duty of Customs.

- At the State level, State Value Added Tax/Sales Tax, Entertainment Tax (other than the tax levied by the local bodies), Central Sales Tax

- Octroi and Entry tax, Purchase Tax, Luxury tax, and Taxes on lottery, betting and gambling

Administration of GST

- There will be two components of GST – Central GST (CGST) and State GST (SGST).

- Both Centre and States will simultaneously levy GST across the value chain. Tax will be levied on every supply of goods and services.

- Centre would levy and collect Central Goods and Services Tax (CGST), and States would levy and collect the State Goods and Services Tax (SGST) on all transactions within a State.

- The input tax credit of CGST would be available for discharging the CGST liability on the output at each stage.

- Similarly, the credit of SGST paid on inputs would be allowed for paying the SGST on output. No cross utilization of credit would be permitted.

- In case of inter-State transactions, the Centre would levy and collect the Integrated Goods and Services Tax (IGST) on all inter-State supplies of goods and services

GSTN

- For the implementation of GST in the country, the Central and State Governments have jointly registered Goods and Services Tax Network (GSTN) as a not-for-profit, non-Government Company to provide shared IT infrastructure

- The key objectives of GSTN are to provide a standard and uniform interface to the taxpayers, and shared infrastructure and services to Central and State/UT governments.

- There would no manual filing of returns. All taxes can also be paid online. Most returns would be self-assessed.

Inflation

- Analysts feel that in the short term, there could be some impact on prices of services which now attract an average service tax of around 14 per cent only at the Central level.

- However, in the case of manufactured products like automobile, the standard GST could be much lower than the combined present effect of excise and state levies.

- However, in the medium to long term, this should play out. On the whole, GST should be anti-dote to inflation.