The Gist of Press Information Bureau: March 2013

The Gist of Press Information Bureau: March 2013

Content

- National Sample Survey Office

- Survey undertaken/ launched

- MPLAD Scheme

- Coordination and Publication (CAP)

- Twenty Point Programme (TPP)

- PM’s Global Advisory Council of Overseas Indians Meets at Kochi

- National Electric Mobility Mission Plan Launched Today

- Aligning ‘National Investment Fund’ Operation to Enhance ‘Disinvestment Policy’

- Executive Committee on Climate Change constituted

- Wildlife Management-Huge Challenge

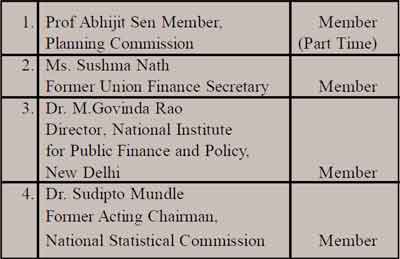

As mandated by the Article 280 of the Constitution, the Government has constituted the Fourteenth Finance Commission consisting of Dr. Y.V.Reddy, former Governor Reserve Bank of India, as the Chairman and the following four other members, namely: -

Shri Ajay Narayan Jha shall be the Secretary to the Commission. The Commission shall make its report available by the 31st October, 2014, covering a period of five years commencing on the 1st April, 2015.

The Commission shall make recommendations regarding the sharing of Union taxes, principles governing Grants-in-aid to States and transfer of resources to local bodies.

Terms of Reference and the matters that shall be taken into consideration by the Fourteenth Finance Commission in making the recommendations are as under:—

- the distribution between the Union and the States of the net proceeds of taxes which are to be, or may be, divided between them under Chapter I, Part XII of the Constitution and the allocation between the States of the respective shares of such proceeds;

-

the principles which should govern the grants-in-aid of the revenues of the States out of the Consolidated Fund of India and the sums to be paid to the States which are in need of assistance by way of grants-in-aid of their revenues under article 275 of the Constitution for purposes other than those specified in the provisos to clause (1) of that article; and

-

the measures needed to augment the Consolidated Fund of a State to supplement the resources of the Panchayats and Municipalities in the State on the basis of the recommendations made by the Finance Commission of the State.

The Commission shall review the state of the finances,

deficit and debt levels of the Union and the States, keeping in view, in

particular, the fiscal consolidation roadmap recommended by the Thirteenth

Finance Commission, and suggest measures for maintaining a stable and

sustainable fiscal environment consistent with equitable growth including

suggestions to amend the Fiscal Responsibility Budget Management Acts currently

in force and while doing so, the Commission may consider the effect of the

receipts and expenditure in the form of grants for creation of capital assets on

the deficits; and the Commission shall also consider and recommend

incentives and disincentives for States for observing the obligations laid down

in the Fiscal Responsibility Budget Management Acts.

In making its recommendations, the Commission shall have regard, among other considerations, to –

- the resources of the Central Government, for five years commencing on 1st April 2015, on the basis of levels of taxation and non-tax revenues likely to be reached during 2014-15;

-

the demands on the resources of the Central Government, in particular, on account of the expenditure on civil administration, defence, internal and border security, debt-servicing and other committed expenditure and liabilities;

- the resources of the State Governments and the demands on such resources under different heads, including the impact of debt levels on resource availability in debt stressed states, for the five years commencing on 1st April 2015, on the basis of levels of taxation and non-tax revenues likely to be reached during 2014-15;

- the objective of not only balancing the receipts and expenditure on revenue account of all the States and the Union, but also generating surpluses for capital investment;

-

the taxation efforts of the Central Government and each State Government and the potential for additional resource mobilisation to improve the tax-Gross Domestic Product ratio in the case of the Union and tax-Gross State Domestic Product ratio in the case of the States;

- the level of subsidies that are required, having regard to the need for sustainable and inclusive growth, and equitable sharing of subsidies between the Central Government and State Governments;

-

the expenditure on the non-salary component of maintenance and upkeep of capital assets and the non-wage related maintenance expenditure on plan schemes to be completed by 31st March, 2015 and the norms on the basis of which specific amounts are recommended for the maintenance of the capital assets and the manner of monitoring such expenditure;

- the need for insulating the pricing of public utility services like drinking water, irrigation, power and public transport from policy fluctuations through statutory provisions;

- the need for making the public sector enterprises competitive and market oriented; listing and disinvestment; and relinquishing of non-priority enterprises;

- the need to balance management of ecology, environment and climate change consistent with sustainable economic development; and

- the impact of the proposed Goods and Services Tax on the finances of Centre and States and the mechanism for compensation in case of any revenue loss.

devolution of taxes and duties and grants-in-aid; however,

the Commission may also take into account the demographic changes that have

taken place subsequent to 1971.5. The Commission may review the present

Public Expenditure Management systems in place including the budgeting and

accounting standards and practices; the existing system of classification of

receipts and expenditure; linking outlays to outputs and outcomes; best

practices within the country and internationally, and make appropriate

recommendations thereon.

The Commission may review the present arrangements as regards financing of Disaster Management with reference to the funds constituted under the Disaster Management Act, 2005(53 of 2005), and make appropriate recommendations thereon. The Commission shall indicate the basis on which it has arrived at its findings and make available the State-wise estimates of receipts and expenditure. The Commission shall make its report available by the 31stOctober, 2014, covering a period of five years commencing on the 1st April, 2015.

FM Statement on Current Account Deficit (CAD); Confident to Finance the Cad ithout Drawing Upon Reserves; Appeal to the People to Moderate the Demand for Gold as IT Leads to Large Imports of Gold

The text of the Union Finance Minister Shri P.Chidambaram’s Statement about Current Account Deficit (CAD) is as follows: I have spoken about the Current Account Deficit (CAD) on a number of occasions. The Current Account Deficit, for the first half of the current year (2012-13) stood at US$ 38.7 billion or 4.6% of GDP.

The main contributors to the CAD were:–

Exports recorded a sharp decline of 7.4%, while imports recorded a smaller decline of 4.3% leading to widening of the trade deficit. Of the imports, gold imports amounted to US$ 20.25 billion.

This was partly made up by an increase in services exports of 4.2% and, consequently, surplus in services which amounted to US$ 29.6 billion.

Remittances of US$ 32.9 billion. Notwithstanding the widening of the CAD, the positive aspect is that the CAD was financed without drawing on reserves. This was mainly due to adequate inflow of FDI (US$ 12.8 billion) and FII (US$ 6.2 billion). In addition, external commercial borrowing amounted to US$ 1.7 billion. The net result is that we have not drawn on the foreign exchange reserves and, in fact, there is a marginal accretion of US$ 0.4 billion to the foreign exchange reserves. As would be evident, gold imports constituted a substantial chunk of the imports and is a huge drain on the Current Account.

Suppose gold imports had been one half of the actual level, that would have meant that our foreign exchange reserves would have increased by US$ 10.5 billion. I would therefore appeal to the people to moderate the demand for gold which leads to large imports of gold. I may add that we may be left with no choice but to make it a little more expensive to import gold. This matter is under Government’s consideration. While the CAD is indeed worrying, I think it is within our capacity to finance the CAD, thanks to FDI, FII and ECB. I would like to once again underscore the crucial importance of FDI and FII. As I have said before, attracting foreign funds to India has become an economic imperative. I am confident that even if the year ends with a slightly larger CAD than last year, we would be able to finance the Current Account Deficit without drawing upon reserves.

YEAR END REVIEW-2012

NATIONAL SAMPLE SURVEY OFFICE:

(NSSO) The National Sample Survey Office (NSSO) under the Ministry of Statistics & Programme Implementation is responsible for carrying out surveys on socio-economic aspects of Indian Economy by collecting data from households and enterprises located in villages and in the towns with a view to update data base for sound planning for development and administrative decisions. Towards this end and objective of the organization, the major achievements during 2012 are as follows:

SURVEY UNDERTAKEN/ LAUNCHED:

-

The field work of two sub-rounds of NSS 68th round on Household Consumer Expenditure & Employment and Unemployment was completed during the year and the field work for NSS 69th round, a six month duration survey, on Drinking Water, Sanitation & Hygiene and Housing Conditions (including slums)started in July 2012 and now has been completed.

- Agricultural Statistics Survey on Sample check on area enumeration and supervision of crop cutting experiments under the scheme for ‘Improvement of Crop Statistics (ICS)’ for the agricultural years 2011-12 and 2012- 3. While the Survey for 2011-12 is completed, the Survey for 2012-13 will continue up to June 2013.

-

Regular price collection surveys in rural areas for compilation of Consumer Price Indices for Rural and Agricultural Labour by Labour Bureau and in urban areas for Consumer Price Index (Urban) by Central Statistics Office (CSO).

- Assistance to Department of Industrial Policy & Promotion (DIPP) in collection of wholesale prices from selected units/ factories for compilation of Wholesale Price Index.

- The data collection work of Annual Survey of Industries for 2010-11 and 2011-12.

New Initiatives Undertaken

(i) All India Periodic Labour Force Survey (PLFS) is in progress in 3 States

viz, Gujarat, Himachal Pradesh and Orissa. The primary objective of the survey

is to measure the dynamics in labour force participation and employment status

in the short time interval of 3 months.

(ii) Experimentation of use of Hand-held devices / gadgets for data collection

in the socio-economic surveys in the field.

(iii) Use of RDBMS system of data processing.

(iv) Data entry at field level in NSS 68th and 69th rounds in the states of Goa,

Jammu & Kashmir, Sikkim and Puducherry.

Reports Released

(i) 96th issue of the NSSO Journal ‘Sarvekshana’.

(ii) Reports/ Results based on NSS rounds.

NSS 66th Round

(a) Informal Sector and Conditions of Employment in India

(b) Nutritional Intake in India

(c) Household consumption of various goods and services in India

(d) Energy Sources of Indian Households for Cooking and Lighting

(e) Employment and Unemployment Situation Among Social Groups in India

(f) Household Consumer Expenditure Across Socio-Economic Groups

(g) Home based workers in India

NSS 67th Round

(a) Key Results of Survey on Unincorporated Non-Agricultural Enterprises

(Excluding Construction) in India

(b) Operational characteristics of Unincorporated Non-agricultural Enterprises

(Excluding Construction) in India

NSS 68th Round

(a) Provisional Results of Household Consumer Expenditure Survey, NSS 68th round (July 20011 - June 2012)

Social Statistics Division

The Social Statistics Division released five publications namely, Manual on Disability Statistics, Manual on Labour Statistics (I), SAARC Social Charter-India Country Report 2012, Women and Men in India 2012, Children in India 2012 – A Statistical Appraisal. The Ministry has constituted two national awards viz, Prof.C.R.Rao award for young Statistician and Prof.P.V.Sukhatme award for life time achievement in Statistics for Indian national in alternate years. In 2012, Prof.P.V. Sukhatme award was jointly awarded to Prof. S.P. Mukherjee, ex Professor, Calcutta University and Prof. Jayant Vinayak Deshpande ex Professor, Pune University. The award carries a prize money of Rs.5 lakhs, a citation and a momento.

MPLAD Scheme

-

Objective: The Member of Parliament Local Area Development Scheme (MPLADS) was launched in December, 1993 to provide a mechanism for the Members of Parliament to recommend works of developmental nature for creation of durable community assets and for provision of basic facilities based on locally felt needs. The annual MPLADS funds entitlement per MP under the scheme has been enhanced from Rs.2 crore to Rs.5 crore w.e.f. 2011-12.

-

Nauture of the Scheme: under the scheme funds are released in the form of Grant-in-aid as Special Central Assistance directly to the Districts. The Ministry of Statistics and Programme Implementation has prescribed a set of guidelines for implementation and monitoring of the scheme. The guidelines are revised from time to time to make it more responsive to the local needs without compromising the basic principles of the scheme. The Guidelines of November, 2005 have been revised and the revised guidelines have been issued in August, 2012. As many as reform circulars on guidelines have been issued in this year till date.

-

Impact: With a view to assess the implementation of the scheme for mid-course correction, a mechanism of physical monitoring of MPLADS works in selected Districts by an independent Institution has been put in place. Third party monitoring of MPLADS works in 208 Districts have been completed during the period 2007 to 2011 by NABCONS. Currently third party physical monitoring has been assigned to M/s AFC Ltd. And is underway in 100 Districts.

-

Physical and Financial Progress of the Scheme since inception:

-

Rs. 26960.25 crore has been released (including release of Rs. 1962 crore up to 30.11.2012 during the financial year 2012-13 since inception of the Scheme. As reported by the Districts, an expenditure of Rs. 24070.88 has been incurred under the Scheme. The percentage utilization over release of 89.28

-

So far 13,87,151 works have been sanctioned and 12,382,87 works been completed. Percentage of works completed to sanction is 89.27.

Coordination and Publication (CAP)

- For Five year Plan 2012-17, the Ministry has been allocated Rs. 3709 crores excluding Member of Parliament Local Area Development Scheme (MPLADS).

- Under India Statistical Strengthening Project (ISSP), Ministry has signed MOUs with 13 States and released Rs. 130.86 crores.

- An MOU was signed with EURO STAT for statistical cooperation.

Infrastructure & Project Monitoring Division (IPMD)

The Infrastructure & Project Monitoring Division (IPMD) monitors the implementation of Central Sector Projects (costing Rs. 150 crore and above) in 14 Infrastructure Sectors as well as the performance of 11 key infrastructure sectors.

As per the latest Report for the month of September, 2012 there are 566 such ongoing Central Sector Projects (costing Rs. 150 crore and above whose original cost of implementation was about Rs. 7,90,572.38 crore and anticipated completion cost likely to be Rs.9,23,573.57 crore. This reflects a cost overrun of 16.8%. 46.5% of the Projects i.e. 263 Projects are delayed, with the average time overrun being about 17.3 months for all projects and 37.1 months for the delayed project.

The infrastructure performance recorded positive growth during the year 2012-13

(April- September) over the corresponding period of the previous year in various sectors such as power generation (4.8%), Production of coal(8.1%), Production of finished steel (2.0%), cement (7.4%), refinery (5.4%), up-gradation of Highway by NHAI (38.8%), goods traffic carried by Railways (4.8%), passengers handled at International terminals (2.6%) of the airports and net addition in switching capacity of telephone exchanges (59.1%). The negative growth over the performance with respect to the previous year was observed in some sectors namely fertilizers (6.0%), crude oil (0.7%) & natural gas (12.5%), & up-gradation of Highway by State PWD and Border Road Organisation(BRO) (9.3%), cargo handled at major ports (3.3%), Cargo handled at airport –[Export (1.6%) & import cargo (9.2%)] and passenger handled at domestic terminals of the airports (3.1%).

Recent Initiatives

To facilitate resolving of various extraneous issues/bottlenecks such as land acquisition, encroachments, delay in issue of clearances and shifting of utilities, etc. Which are increasingly having a bearing on the implementation of Central Sector Projects, all States have been requested to constitute Central Sector Projects Coordination Committees under the Chief Secretaries in which concerned PSU s in the State, the concerned Departments of State Government and Agencies etc. are also represented.

Recognizing the importance of Project Management in the improving the project implementation, this Ministry is supporting various initiatives in promoting the Project Management discipline and training. Five-day training for public sector employees in project management is being organized by this Ministry once in each quarter. Over 200 executive have benefitted from it.

The Review meeting on the implementation of Projects in the state of Odisha have been taken up, by the Hon’ble Minister with the IOCL, RVNL, MCL & NHAI. The minute have been circulated for taking necessary action to all concerned.

Field visits to various project sites of JNPT, MbPT, NHAI & IOC etc. have been taken to understand the constraints and appropriate suggestion were made to resolve the same.

Twenty Point Programme (TPP)

The Twenty Point Programme (TPP) was launched by the Government of India in the year 1975 and has been restructured thrice in 1982, 1986 and again in 2006. The restructured programme, known as Twenty Point Programme (TPP) – 2006, became operational with effect from, 1st April, 2007. The TPP-06 is meant to give a thrust to schemes relating to poverty alleviation, employment generation in rural areas, housing, education, family welfare & health, protection of environment and many other schemes having a bearing on the quality of life, especially in the rural areas. The Twenty Point Programme (TPP) – 2006 consists of 20 points with 65 items which are monitored on annual basis. Out of the 65 items, 20 items are monitored on monthly basis also on the basis of progress report submitted by state Government. UT Administrations and concerned Central Nodal Ministries. Performance of 15 of the 20 items is monitored against pre-set targets which are fixed by concerned Central Nodal Ministries.

The Ministry releases a Monthly Progress Report (MPR) on implementation of monthly monitored items. During the financial year 2012, MPR’s have been released for the months of October, 2011 to September, 2012 respectively. In addition to MPR, an Annual Review Report on TPP- 2006 covering progress of implementation of all items during the year under TPP-2006 is also released. During 2012, Annual Review Report for 20010-11 has been released.

In order to strengthen the monitoring of the implementation framework of schemes/programmes covered under TPP-06 TPP Division of the Ministry has been mandated to undertake Monitoring and Impact Assessment Studies on selected programmes/schemes covered under TPP-2006. So far, the Ministry has undertaken two Impact Assessment Studies. First relates to impact of MGNREGA in 3 selected districts of North Eastern States namely Mon (Nagaland), , Saiha (Mizoram), Dhalai (Tripura), The second study related to rehabilitation of Disabled persons under Deendayal Disability Rehabilitation Scheme (DDRS) in the States of Delhi, Karanataka, Madhya Pradesh and West Bengal.

Twenty Point Programme was last revised in 2006 which came

into operation in April 2007. Since then, the priorities of the Government have

shifted from 10th Plan to 11th Plan to 12th Plan. Beside these the Government

has taken initiatives in the form of “Bharat Nirman” and other Flagship

Programmes. In order to accommodate these policy changes and thrusts, the

Ministry has initiated a proposal to revamp the TPP.

Ministry of Statistics & PI also undertakes review meeting at National and State

levels as part of monitoring and consultation mechanism. Two National Review

Meeting of TPP-06 have been successfully held so far on 28.10.10 and 11.11.11

respectively. These review meeting are held to review the overall progress of

schemes/programmes so to improve the implementation of schemes/ programmes

covered under TPP. These meetings addressed the core issues with States Govts/UT

Administrations and with concerned nodal Ministries viz. State –wise performance

of programmes and Schemes covered under Twenty Point Programme , variation in

reported performance figures by States/UTs and furnished by Central Nodal

Ministries. Delay in reporting of monthly performance figures, Constitution of

TPP Monitoring committees at State, District & Block levels and their meetings

at regular interval, Target fixation approach taken by central nodal ministries,

suggestions for revamping of TPP-2006, need for a single portal of TPP,

difficulties faced by the implementing agencies in the implementation of

schemes/programmes and suggestion for dropping obsolete schemes/programmes and

inclusion of new schemes in view of the Bharat Nirman and new flagship

programmes of Govt. of India.

PM’s Global Advisory Council of Overseas Indians Meets at Kochi

The Prime Minister Dr. Manmohan Singh chaired the fourth meeting of the Global Advisory Council of Overseas Indians on 8 January 2013 at Kochi. Thirteen eminent Overseas Indians from across the world attended the meeting. Shri Vayalar Ravi, Minister of Overseas Indian Affairs; Shri Anand Sharma, Minister of Commerce and Industry; Shri Salman Khursheed, Minister of External Affairs; Shri M.M. Pallam Raju, Minister of Human Resource Development; Dr. Montek Singh Ahluwalia, Deputy Chairman, Planning Commission; and senior officials of Government of India also attended the meeting.

The Eminent Overseas Indians present included Shri Karan F.Bilimoria, Shri Swadesh Chatterjee, Ms. Ela Gandhi, Lord Khalid Hameed, Dr. Renu Khator, Shri Kishore Mahbubani, Shri L.N.Mittal, Lord Bhiku Chotalal Parekh, Shri Sam Pitroda, Tan Sri Dato’ Ajit Singh, Mr. Neville Joseph Roach, Prof. Srinivasa SR Varadhan and Shri Yusuffali M.A.

During the meeting, the participants exchanged views on key international issues and their implications for India, including the global economic situation; developments in West Asia and the Gulf region; energy security; and trends in the Asia Pacific region. The members also gave their perspectives on strengthening engagement between India and the Overseas Indians as well as between India and various countries in the bilateral sphere. Prime Minister thanked the members for their perspective and constructive suggestions.

Prime Minister’s Global Advisory Council of Overseas Indians was constituted in 2009 and meets annually. Its objective is to draw upon the experience and knowledge of eminent Overseas Indians in diverse fields from across the world, to develop a comprehensive agenda for engagement between India and the Diaspora.

National Electric Mobility Mission Plan Launched Today

The Hon’ble Prime Minister today unveiled the National Electric Mobility Mission Plan (NEMMP) 2020 in the presence of Shri Praful Patel, Minister for Heavy Industries & Public Enterprises and Shri Montek Singh Ahluwalia, Dy. Chairman, Planning Commission. The ceremony was attended by eminent leaders from the automotive industry, academia and research institutes, officers of stakeholder Ministries, National Manufacturing Competitiveness Council.

The principal end objectives of the National Mission for Electric Mobility (NMEM) are National energy security, mitigation of the adverse impact of vehicles on the environment and growth of domestic manufacturing capabilities. The NEMMP 2020, the mission document for the NMEM that was approved by the National Council for Electric Mobility (NCEM) on 29th August, 2012, sets the vision, lays the targets and provides the joint Government – industry vision for realizing the huge potential that exists for full range of efficient and environmentally friendly electric vehicle (including hybrids) technologies by 2020.

The NEMMP 2020 is a well researched document and relies on in-depth primary data based study conducted jointly by the Government and the Industry which indicates that high latent demand for environmentally friendly electric vehicle technologies exists in the country. As per these projections, 6-7 million units of new vehicle sales of the full range of electric vehicles, along with resultant liquid fuel savings of 2.2 – 2.5 million tonnes can be achieved in 2020. This will also result in substantial lowering of vehicular emissions and decrease in carbon di-oxide emissions by 1.3% to 1.5% in 2020 as compared to a status quo scenario.

However, in view of the significant barriers that exist today for these frontier technologies, the global experience indicates that this is an area where Governments need to focus their efforts and provide support that is necessary for creation of the eco system and viable self sustaining business in the near future. This includes providing initial impetus through demand support measures that facilitate faster consumer acceptance of these expensive newer technologies. In addition, Government will also need to facilitate automotive R&D and put in place charging infrastructure. It is estimated that the Government will need to provide support to the tune of Rs 13000 – Rs 14000 Crore over the next 5-6 years. The industry will also need to match this with a much larger investment for developing the products and creating the manufacturing eco-system.

The NEMMP 2020 projections also indicate that the savings from the decrease in liquid fossil fuel consumption as a result of shift to electric mobility alone will far exceed the support provided thereby making this a highly economically viable proposition. Therefore on all counts encouraging the faster adoption of hybrid & electric vehicles and their manufacture in India is a wise investment for our future generations.

NMEM is amongst the most significant interventions of the Government that promises to transform the automotive paradigm of the future by lessening the dependence on fossil fuels, increasing energy efficiency of vehicles and by providing the means to achieve ultimate objective of cleaner transportation that is compatible with sustainable renewable energy generation. This Intervention will also help encourage the Indian Automotive Industry to shift to newer, cleaner technologies so that it builds its future competitive advantage around environmentally sustainable products, high end technologies, innovation and knowledge.

The implementation and roll out of the NEMMP 2020 will be done through various specific schemes, interventions, policies that are currently under formulation and will be considered by the Government in the near future.

Aligning ‘National Investment Fund’ Operation to Enhance ‘Disinvestment Policy’

The Cabinet Committee on Economic Affairs today approved the following:

(i) The disinvestment proceeds with effect from the fiscal year 2013-14 will

be credited to the existing “public account” under the head National Investment

Fund (NIF), and they would remain there until withdrawn/invested for the

approved purposes.

(ii) The NIF will be used for the following purposes:

(a) Subscribing to the shares being issued by the Central Public Sector Enterprise (CPSE) including Public Sector Banks (PSBs) and Public Sector Insurance Companies, on rights basis so as to ensure that 51 percent ownership of the Government is not diluted.

(b) Preferential allotment of shares of the CPSE to promoters as per Securities and Exchange Board of India SEBI (Issue of Capital and Disclosure Requirements) Regulations, 2009 so that Government shareholding does not go down below 51 percent, in all cases where the CPSE is going to raise fresh equity to meet its capex programme.

(c) Recapitaliztion of PSBs and Public Sector Insurance Companies.

(iii) Fund Managers presently managing the NIF will stand discharged of their responsibility from the date the funds and the interest income are transferred to the fund.

The NIF was constituted by the Cabinet Committee on Economic Affairs on 27th January 2005. The objectives structure and administrative arrangements, investment strategy were notified in November, 2005, and the NIF started functioning from October, 2007. As on 31st August 2012 the corpus in the NIF consisted of Rs.1814.45 crore, comprising the disinvestment proceeds of Power Grid Corporation of India and the Rural Electrification Corporation Limited done during 2007-08. This corpus is presently invested through three Public Sector fund managers (SBI, LIC and UTI Mutual Funds).

Executive Committee on Climate Change constituted

The Prime Minister has decided to constitute an Executive Committee on Climate Change to assist the Prime Minister’s Council on Climate Change. The Executive Committee on Climate Change would focus on the following tasks:

1. Assist the PM’s Council on Climate Change in evolving a coordinated

response to issues relating to climate change at the National level.

2. Regularly monitor the implementation of the eight national missions and other

initiatives on Climate Change.

3. Advise the PM’s Council on Climate Change on modifications in the objectives,

strategies and structure of the missions, as may be necessary.

4. Co-ordinate with various agencies on issues relating to climate change.

The Chairman of the Executive Committee on Climate Change will be the Principal Secretary to the Prime Minister and Secretary, Ministry of Environment and Forests will be the Member-Convenor. Other members of the Committee include Cabinet Secretary, Finance Secretary, Secretary, Planning Commission, Secretary, Ministry of Power, Secretary, Ministry of New & Renewable Energy, Secretary, Ministry of Urban Development, Secretary, Water Resources, Secretary, Department of Science & Technology, Secretary, Department of Agriculture & co-operation, Secretary, Department of Agricultural Research & Education, Secretary, Department of Earth Sciences, Secretary, Ministry of Coal, Secretary, Ministry of Petroleum & Natural Gas, Secretary, Department of Economic Affairs. The Chairman of Executive Committee on Climate Change may invite any other officer/Expert to the meetings as may be necessary. The PM’s Council on Climate Change and the Executive Committee on Climate Change would be serviced by Ministry of Environment and Forests. The Prime Minister’s Council on Climate Change was constituted in 2007, in order to co-ordinate National Action for Assessment, Adaptation and Mitigation of Climate Change. The National Action Plan of Climate Change (NAPCC) was released by the Prime Minister in June 2008. Under the NAPCC, with the approval of PM’s Council on Climate Change, eight national missions are being implemented.