(HOT) UPSC Current Affairs 2025 PDF

NEW! The Gist (JAN-2026) | E-BOOKS

The Gist of Yojana: May + June 2013

The Gist of Yojana: May + June 2013

Contents

- Budget Proposals–As Overview

- Growth in GDP at Factor Cost at 2004·5 Prices (Percent)

- Budget 2013–14 and Beyond: What it Means for Fiscal Consolidation?

- Budget: Concepts and Terminologies

- A Power Sector Review of Budget

- Agriculture and Budget

- Procedures for Foreign Portfolio Investors Simplified

- Social Sector Outlays–As Assessment

- India’s Defence Budjet

- Land Use and Agrarain Relations

- Land Management can Improve Rural Economy

BUDGET PROPOSALS–AS OVERVIEW

Union Budget ended out creditably on the main task for fiscal 2012-13. It kept the fiscal deficit under control at 5.2 percent of GDP instead of the often feared 6 percent estimate, as late as September 2012. Though superficially the dip in the fiscal deficit is just a marginal improvement from the revised target of 5.3 percent, it is the first time since 2008-09 that the fiscal deficit calculated by the finance ministry will dip close to 5 percent. This is significant considering that the current account deficit will also close out this fiscal almost at 5 percent. Further, the revenue deficit has been contained at 3.9 percent in the current fiscal and would be brought down to 3.3 percent in 2013-14.

Budget 2013-14 has staved off the downgrade from international rating agencies, plumped for investment at the cost of consumption and tried to make India a better place to invest in. “In the process it has been harsh on expenditure. The Finance Minister has used the scalpel on the subsidies too. As the medium term fiscal policy statement notes “Major subsidies in the Revised Estimates for 2012- 13 have increased to Rs 2,47,854 crore as compared to the Budget Estimates for 2012-13 of Rs 1,79,554 crore. The major part of increase has come from petroleum subsidies that went up from Rs 43,580 crore in BE 2012-13 to Rs 96,880 crore in RE 2012-13”. This is a 122 percent rise that the minister has clawed back in 2013-14.

So what is the scene with major subsidies? They are budgeted at Rs 2,20,972 crore in BE 2013-14. Total subsidies are at 2.6 percent of GDP in RE 2012- 13 and are budgeted to be at 2 percent of GDP in 2013- 14, the commitment the finance minister has taken on from the Vijay Kelkar committee. The subsidy bill is pegged lower by 11 percent in 2013-14. The Budget hopes to cap the total expenditure on major subsidies including fuel, food and fertiliser at Rs 2,20,971.50 crore for the 201,3-14 fiscal as against Rs 2,47,854 crore in the revised estimates for this fiscal. Interestingly, the revised estimates for this fiscal are higher by 38 percent compared to the budget estimate of Rs 1,79,554 crore. While the oil subsidy is pegged at Rs 65,000 crore for next fiscal against the revised estimate (RE) of Rs 96,880 crore in 2012-13 fiscal, the food subsidy is estimated to rise to Rs 90,000 crore next fiscal from the RE of Rs 85,000 crore in 2012-13. The fertiliser subsidy is also pegged slightly lower at Rs 65,971.50 crore in the next fiscal, as against the RE of Rs 65,974 crore in 2012-13 fiscal.

To balance these giveaways the budget has built in an aggressive tax mobilisation target. It includes Rs 18,000 crore of additional revenue mobilisation measures. The same document says “With these measures tax revenues in 2013-14 are expected to grow at 19.1 percent. The tax to GDP ratio estimated in the Budget for 20 13-14 is 10.9 percent. Budget Estimates for 2013-14 assumes a normal tax growth of 17 percent over RE 2012-13 and remaining tax growth emanating from additional resource mobilization measures.

The bleak economic outlook gives the minister space to keep tax giveaways to almost nil this year. Once economic growth returns next year there will be demands for tax breaks. The fiscal policy statement points out “As the tax to GDP ratio increases, further improvements would be more gradual and difficult to achieve. The outlook for tax revenues for the years 2014-15 and 2015-16 has been designed keeping this in mind”. In a hope to reach a tax to GDP ratio of 11.9 percent, the Budget has estimated a 19 percent rise in revenue receipts to Rs 10,56,331 crore in 2013-14 as compared to a revised estimate of Rs 8,71,828 crore for the fiscal.

So far as the market borrowings are concerned, the gross market borrowings have been pegged at a record Rs 6,29,009 crore in 2013-14, the net borrowings are expected to rise to Rs 4,84,000 crore. This is just a 3.5 percent rise over the revised estimate of Rs 4,67384 crore in the current fiscal. The difference is due to the record redemption of bonds estimated at Rs 1,45,009 crore in 2013-14. It is betting heavily on proceeds from disinvestment in state owned firms to help finance the ambitious fiscal deficit target. The Budget has doubled the disinvestment target for next fiscal to Rs 40,000 crore, as against a revised estimate of Rs 24,000 crore in the current fiscal. In addition, the government is also betting on raising Rs 14,000 crore from selling off its residual stake in Hindustan Zinc, Balco and SUUTI.

It is betting heavily on proceeds from disinvestment in state owned firms to help finance the ambitious fiscal deficit target. The Budget has doubled the disinvestment target for next fiscal to Rs 40,000 crore, as against a revised estimate of Rs 24,000 crore in the current fiscal. In addition, the government is also betting on raising Rs 14,000 crore from selling off its residual stake in Hindustan Zinc, Balco and SUUTI.

Though finance minister P Chidambaram did not announce the disinvestment target in his speech, the total estimate of Rs 55,814 crore works out to the highest target from stake sale proceeds in over a decade.

Among the sectoral initiatives the finance minister announced that independent regulator will be expected to provide solutions to revive among other the road sector, which has seen a slowdown in award and implementation of projects.

To be eligible to claim the benefits the home buyers will have to buy their first home whose value should not exceed Rs 40 lakh and the home loan should be restricted to Rs 251akh. While the loan needs to be taken between April 1,2013 and March 31, 2014, the buyer can claim the available benefit of deduction Rs 1 lakh over a period of two years.

In case the loan is taken in the middle of 2013-14, the buyer can claim the applicable benefit in the assessment year beginning April 2014 and the remaining amount can be claimed in the next assessment year. For the capital markets in an effort to bring the derivative trading in commodities and the securities market at par, the finance minister announced the commodities transaction tax (CTT) of 0.01 percent of the price of the trade on all commodities except agricultural commodities.

The finance minister also announced reduction of the securities transaction tax on equity futures from existing 0.17 percent to 0.01 percent bringing both CTT and STT at par.

“There is no distinction between derivative trading in the securities market and derivative trading in the commodities market, only the underlying asset is different. I propose to levy CTT on non-agricultural commodities futures contracts at the same rate as on equity futures, which is at 0.01 percent of the price of the trade,” said the Finance Minister in his speech.

To revive the weakened investment climate in the country and to quicken the implementation of projects, the budget 2013-14 proposed to offer incentives to companies that step in to make investments. The finance minister has also announced an investment allowance of 15 percent for all new high value investments of more than Rs 100 crore over the next two financial years. The benefit will be in addition to the current rates of depreciation. It has however taken couple of measures to plug the loopholes for tax avoidance by companies.

But, what about inflation management? The Reserve Bank of India would soon launch inflation-indexed bonds to make people move away from gold as the instrument of effective hedge against inflation. “This will be done next fiscal. We will have our cash and debt management meeting towards the end of this financial year and hopefully, from the first or second month of the next fiscal, we will launch inflation-indexed bonds,” RBI Deputy Governor HR Khan told reporters. The central bank has been planning to introduce IIBs to keep investors away from gold as a hedge against inflation. The final surmise-a tough set of decisions in a difficult year, that is what Budget 2013-14 will be known as.

12th Plan Projects Investment of Rs 55,00,000 Crore in Infrastructure

While presenting the Budget for 2013-14, the Finance Minister P. Chidambaram said that the growth rate of an economy is correlated with the investment rate. The key to restart the growth engine is to attract more investment, both from domestic investors and foreign investors. He said that efforts will be made to improve communication of the country’s policies to remove any apprehension or distrust in the minds of investors, including fears about undue regulatory burden or application of tax laws. ‘Doing business in India’ must be seen as easy, friendly and mutually beneficial.

While every sector can absorb new investment, it is the infrastructure sector that needs large volumes of investment. The 12th Plan projects an investments of USD 1 trillion or Rs. 55,00,000 crore in infrastructure. The Plan envisages that the private sector will share 47 percent of the investment. Besides, India needs new and innovative instruments to mobilize funds for this order of investment. Government has taken or will take the following measures to increase investment in infrastructure:

Infrastructure Debt Funds (IDF) will be encouraged. These funds will raise resources and, through take-out finance, credit enhancement and other innovative means, provide long-term low-cost debt for infrastructure projects. Four IDFs have been registered with SEBI so far and two of them were launched in the month of February, 2013.

India Infrastructure Finance Corporation Ltd (IICL), in

partnership with the Asian Development Bank, will offer credit enhancement to

infrastructure companies that wish to access the bond market to tap long term

funds.

In the last two years, a number of institutions were allowed to issue tax free

bonds. They raised Rs. 30,000 crore in 2011-12 and are expected to raise about

Rs. 25,000 crore in 2012-13. It is proposed to allow some institutions to issue,

tax free bonds in 2013-14, strictly based on need and capacity to raise money in

the market, upto a total sum of Rs. 50,000 crore.

Multilateral Development Banks are keen to assist in efforts to promote regional connectivity. Combining the ‘Look East’ policy and the interests of the North Eastern States, it is proposed to seek the assistance of the World Bank and the Asian Development Bank to build roads in the North Eastern States and connect them to Myanmar.

NABARD operates the Rural Infrastructure Development Fund (RIDF). RIDF has successfully utilized 18 tranches so far. It is proposed to raise the corpus of RIDF-XIX in 2013-14 to Rs.20,000 crore. Pursuant to the announcement made last year, a sum of Rs. 5000 crore will be made available to NABARD to finance construction of warehouses, godowns, silos and cold storage units designed to store units designed to store agricultural produce, both in the public and the private sectors. This window will also finance, through the State Governments, construction of godowns by panchayats to enable farmers to store their produce the Finance Minister announced.

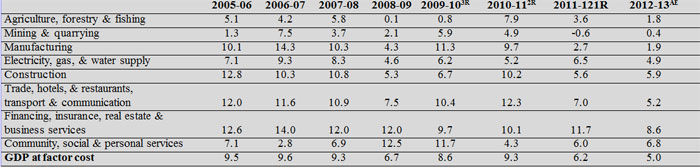

Growth in GDP at Factor Cost at 2004·5 Prices (Percent):

Source: Central Statistics Office (CSO).

Notes:

-

1R: First Revised Estimate,

-

2R: Second Revised Estimate,

-

3R: Third Revised Estimate,

-

AE: Advance Estimate.

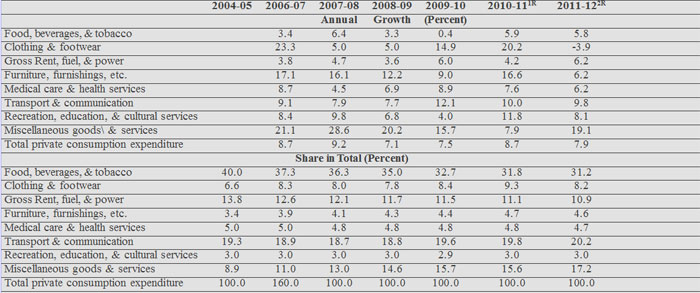

Private Final Consumption Expenditure: Annual Growth and Shares at 2004–2005 Price

Source: CSO.

Notes:

-

1R: First Revised Estimate,

-

2R: Second Revised Estimate

How is the Union Budget Formulated?

The budget process in India, like in most other countries, comprises four distinct phases:

(i) Budget formulation- preparation of estimates of

expenditure and receipts for the ensuing financial year;

(ii) budget enactment- approval of the proposed Budget by the Legislature

through the enactment of Finance Bill and Appropriation Bill;

(iii) budget execution- enforcement of the provisions in the Finance Act and

Appropriation Act by the government-collection of receipts and making

disbursements for various services as approved by the Legislature;

(iv) legislative review of budget implementation- audits of government’s

financial operations on behalf of the Legislature.

Process Commences in August-September

By convention, the Union Budget for next financial year is presented in Lok Sabha by the finance minister on the last working day of February. However, the process of budget formulation starts in the last week of August or the first fortnight of September. To get the process started, the Budget Division in the Department of Economic Affairs under the Ministry of Finance issues the annual budget circular to all the Union government ministries/departments around August- September. The Circular contains detailed instructions for these ministries/ departments on the form and content of the statement of budget estimates to be prepared by them.

Three kinds of figures in a Budget

The ministries are required to provide three different kinds

of figures relating to their expenditures and receipts during this process of

budget preparation. These are: budget estimates, revised estimates and actuals.

Let’s understand this in the context of Union budget 2013-14, which was

presented, as usual, on 28th of February 2013 by the Finance Minister, Shri P

Chidambaram on the floor of Lok Sabha. However, the process of its formulation

would have got started in August 2012 through issuance of budget circular of the

Budget Division and this process would have continued till February 2013.

The approval of Parliament is sought for the estimated receipts/expenditures for 2013-14, which would be called budget estimates. At the same time, the Union government, in its budget for 2013-14, would also present revised estimates for the ongoing financial year 2012-13. The government would not seek approval from Parliament of revised estimates of2012-13; but, these revised estimates allow the government to reallocate its funds among various ministries based on the implementation of the budget for 2012-13 during the first six months of financiala year 2012-13. Finally, ministries also report their actual receipts and expenditures for the previous financial year 2011-12. Hence, the Union budget for 2013-14 consists of budget estimates for 2013-14, revised estimates for 2012-13, and actual expenditures and receipts of 2011-12.

Planning Commission comes in

The ministries would provide budget estimates for plan expenditure for budget estimates for the next financial year, only after they have discussed their respective plan schemes with the Central Planning Commission. The Planning Commission depends on the finance ministry to first arrive at the size of the gross budgetary support, which would be provided in the budget for the next annual plan of the Union government. In principle, the size of each annual plan should be derived from the approved size of the overall Five-Year Plan (12th Five-Year Plan, 2012-13 to 2016-17, in the present instance). However, in practice, the size of the gross budgetary support for an annual plan also depends on the expected availability of funds with the finance ministry for the next financial year.

Reducing deficit, a Priority

In the past few years, the finance ministry has been vociferously arguing for reduction of fiscal deficit and revenue deficit of the Union government, citing the targets set by the Fiscal Responsibility and Budget Management Act and its rules. Hence, presently, the aspirations of the Planning Commission and Union government ministries with regard to spending face the legal hurdle of this Act, which has made it mandatory for the Union government to show the revenue deficit as nil (total revenue expenditure not exceeding total revenue receipts by even a single rupee) and the fiscal deficit as less than 3 per cent of GDP. This means new borrowing of the government in a financial year cannot exceed 3 per cent of the country’s GDP for that year.

Final Stages of Budget Preparation

During the final stage of budget preparation, the revenue-earning ministries of the Union government provide the estimates for their revenue receipts in the current fiscal year (revised estimates) and next fiscal year (budget estimates) to the finance ministry. Subsequently, usually in the month of January, more attention is paid to finalisation of the estimated receipts. With an idea about the total requirement of resources to meet expenditures in the next fiscal year, the finance ministry focuses on the revenue receipts for the next fiscal.

At this stage of budget preparation, the finance minister examines the budget proposals prepared by the ministry and makes changes in them, if required. The finance minister consults the Prime Minister, and also briefs the Union Cabinet, about the budget at this stage. If there is any conflict between any ministry and the finance ministry with regard to the budget, the matter is supposed to be resolved by the Cabinet.

Consultations with Various Stakeholders Crucial

In the run-up to Union Budget each year, the Finance Minister holds pre-budget consultations with relevant stakeholders. The FM also holds consultations with Finance Ministers of States/Union Territories as well as Trade and Industry representatives. This has great significance for the process of budget formulation as it helps the FM take decisions on suitable fiscal policy changes to be announced during the budget.

For this year’s budget, representatives from the agriculture sector, various trade unions, economists, banking and financial institutions and also social sector groups participated in these consultations in January 2013.

Among others, a delegation of People’s Budget Initiative also met Finance Ministry officials and shared the People’s Charter of Demands in the month of January 2013. But this year too, like in previous years, the process started late. Desired changes in expenditure programmes and policies can be influenced only if the consultations are begun earlier, preferably in October.

Consolidation of Budget Data

As the last steps, the budget division in the finance ministry consolidates all figures to be presented in the budget and prepares the final budget documents. The National Informatics Centre (NIC) helps the budget division in the process of consolidation of the budget data, which has been fully computerised. At the end of this process, the finance minister takes the permission of the President of India for presenting the Union budget to Parliament. It would be useful to point out that while the second and the third stage in the budget cycle of our country are reasonably transparent, the first stage of actual budget preparation cannot be said to be open. The process is rather carried out behind closed doors.

Taxation : Highlights; Union Budget 2013/14

-

Tax Savings of Rs. 2000 for assessee having taxable income upto Rs. 5 Lakhs

-

Additional deduction of interest upto Rs. I Lakhs for persons taking home loan (not exceeding Rs. 25 Lakhs) for their first home(not exceeding Rs. 40 Lakhs) during the period 01-04-2013 to 31-03-2014

-

10 percent Surcharge on Individual, HUF, Partnership firms if the taxable income exceeds Rs. l Crores

-

10 percent Surcharge on domestic Companies if the taxable income exceeds Rs. 10 Crore. (5 percent - Surcharge if the taxable income exceeds Rs. 1 Crore) - Valid only for 1 year

-

5 percent Surcharge on foreign Companies if the taxable income exceeds Rs. 10 Crore. (2 percent Surcharge if the taxable income exceeds Rs. 1 Crore) - Valid only for 1 year

-

Surcharge on Dividend Distribution Tax etc increased from 5 percent to 10 percent

-

Investment allowance of 15 percent for companies investing Rs. 100 Crore or more in plant and machinery during 01-04-2013 to 31-03-2015

-

STT Reduced on Equity Futures/ MF Units.

-

Commodity transaction tax introduced on non-agricultural commodities futures contracts

-

One percent TDS on the value of the transfer of immovable property (except agricultural land) where the consideration exceeds Rs. 50 Lakhs

-

Gross Total Income Limit under Rajiv Gandhi Equity Savings Scheme has been increased from 10 Lakhs to 12 Lakhs which shall be allowed for three consecutive assessment years.

Service Tax

-

All AC restaurants (Whether serving Alcohol or not) are subjected to Service Tax

-

Service Tax to be charged on Vehicle Parking fees

Excise

-

Specific Excise Duty Increased on Cigarettes, Cigars, Cheroots, Cigarillos

-

Excise Duty increased on SUV (Except those registered as taxis) from 27 percent to 30 percent

-

Excise duty increased on mobile phones (Pricing above Rs. 2000) from 1 percent to 6 percent Customs

-

Duty free jewellery allowed from abroad in case of gentleman - Rs. 50000, in case of Lady-Rs. 100000.

Do You Know?

What is Fiscal Responsibility and Budget Management Act?

The Fiscal Responsibility and Budget Management (FRBM) Act was enacted by the Parliament in 2003. Its objective is to institutionalise fiscal discipline, reduce fiscal deficit and improve macro economic management. This law aims at promoting fiscal stability for the country on a long-term basis. It emphasises a transparent fiscal management system and a more equitable distribution of debts over the years. This law also gives flexibility to the Reserve Bank of India to undertake monetary policy to control inflation.

Government needs resources for funding various kinds of developmental schemes and routine expenditures. Resources are raised through taxes and borrowing. The government can raise funds by borrowing from the Reserve Bank of India, financial institutions or from the public by floating bonds. Fiscal deficit is the total expenditure minus the revenue receipt, loan recoveries and receipts from disinvestment etc. It is a measure of the government borrowing in a year.

However, uncontrolled fiscal deficit is considered harmful for the health of economy. FRBM Act was notified in 2004 in response to the need felt to curb large fiscal deficit. The FRBM rules specify annual reduction targets for fiscal indicators. Originally, the act envisaged revenue deficit to be reduced to nil in five years beginning 2004-05. Fiscal deficit was required to be reduced to 3 percent of GDP by 2008-09. The Act also provides exception to the government in case of natural calamity and for national security.

The implantation of the act was put on hold in 2007-08 due to global financial crisis and the need for fiscal stimulus. There was a need for increased government expenditure to create demand to fight off the financial downturn and hence the government moved away from the path of fiscal consolidation for this period.

This law also prohibits borrowing by government from the Reserve Bank of India and purchase of primary issues of central government securities after 2006. The act asked the Central government to lay in Parliament three statements in one financial year about the fiscal policy. To enforce fiscal discipline at the state level, the Twelfth finance commission provided for incentives to states through conditional debt restructuring and interest rate relief.

In 2012, the FRBM was amended and it was decided that the FRBM would target effective revenue deficit in place of revenue deficit. Effective revenue deficit excludes capital expenditure from revenue deficit and thus gives space to the government to spend on creation of capital assets.

The critics of this law feel, it would curb the government’s social sector spending but there is no denying the fact that the need for fiscal sustainability cannot be ignored.

What is GST?

The Goods & Services Tax (GST) is an indirect tax reform

measure which will replace all other indirect taxes such as Central Sales Tax,

Octroi, excise duty, Service Tax and Value Added Tax (VAT) at the central and

state levels. India will have a ‘dual GST’ system where states and the centre

both would have power to levy taxes on goods and services. Exports would be an

exception and GST will not be imposed on them. Under the GST, no distinction is

made between goods and services for purpose of levying tax. GST is a value added

tax where the person paying tax on his output is also entitled to get input tax

credit on the tax paid on its inputs.

The idea of GST was first proposed in the budget speech of 2006-07 which had set

out the deadline of 2010 for its introduction in the country. To implement such

a tax regime a constitutional amendment would be needed as the Centre as well

the States are involved in this issue. The government expects that the

legislative process for the enactment of the GST would be started in the next

few months. The Finance Minister has expressed the hope that the two tax reforms

- the GST and Direct Tax Code (DTC) will be implemented soon.

The objective of GST is to make the taxation simple and to broaden the tax base. It will also help create a common market throughout the length and breadth of the country. The GST has the advantage of redistributing the burden of taxation equitably between manufacturing and services. The rate of taxation is also likely to come down with the introduction of GST. Goods of basic importance will have lower tax rates. Better compliance and increased tax collection will boost the tax to GDP ratio. Economic growth is also likely to get an impetus through GST. A report of National Council of Applied Economic Research has estimated an increase of 0.9 percent to 1.7 percent in the economic growth with the implementation of GST. Exports is will also increase according to this study.

Budget 2013–14 and Beyond: What it Means for Fiscal Consolidation?

It May not be an exaggeration to say that Budget 2013-14 has been crafted in most challenging macroeconomic circumstances reflected in high fiscal imbalance, declining GDP growth, high inflation, increasing current account deficit (CAD) and an uncertain global economic environment. Rising crude prices in the international market and increasing gold import as an instrument of asset holding increased the CAD and thereby external sector imbalance. These external shocks further compounded the problem of macro instability in presence of high fiscal deficit and stubbornly high inflation. There is no doubt that the budget 2013-14, squarely focused on fiscal consolidation. The idea is that fiscal consolidation would revive growth and if growth picks up that would help correct other macro imbalances and challenges of development through higher growth of public revenues. Thus, the question is would growth pick up in the short run due to measures of fiscal consolidation proposed in the budget? Lot would depend upon host of macroeconomic factors; both on the fiscal and monetary side, including critical reforms like GST.

High fiscal deficit of the central government is not a new phenomenon. It remained at an uncomfortably high level since 2008-09. Alternative estimates before the budget suggested that the fiscal deficit will be close to 6 per cent of GDP in 2012-13 (RE). However, the budget 2013-14 (BE) pegged the fiscal deficit at 4.8 per cent of GDP and as per the 2012-13 (RE), it is expected to be 5.2 per cent of GDP. The biggest challenge would be to maintain these targets as the fiscal year progresses. Although, achieving these targets assume priority, we need to recognise the fact that path of fiscal adjustment is equally important as the target.

Before we comment on the path of fiscal adjustment, it may be worthwhile to see the nature of fiscal imbalance of the central government. As evident from the fiscal deficit is driven by revenue deficit. In the year 2011-12, the share of revenue deficit in fiscal deficit was 76.43 per cent. But the Budget 2013-14 (BE) expects it to be at 70 per cent. In other words, major share of the borrowed resources are being used to finance the revenue expenditure of the centre which is by and large in nature of current consumption. Although, this sounds quite alarming, the effective revenue deficit (ERD), which is the component of revenue deficit when adjusted for grants given for creation of capital assets, for the year 2013-14 (BE) estimated at 1.8 per cent of GDP. The practice of estimating ERD is a recent introduction in our budget. The significance of the concept of ERD would depend on the nature of use of the grants given for capital assets. If funds used remains by nature of consumption, depending on ERD as a measure of fiscal prudence would be misleading.

New Measures for Welfare of SC/ST, Women and Minorities

Sharing the concerns of the Members of the House for the welfare of the scheduled castes and the scheduled tribes, the Finance Minister P. Chidambaram announced that the Budget has sub plans for them and reiterated that the funds allocated to the sub plans cannot be diverted and must be spent for the purpose of the sub plans. He made an allocation of Rs. 41, 561 crore to the scheduled castes sub plan and Rs. 24,598 crore to the tribal sub plan. Similarly, sufficient allocations have been made to programmes relating to women and children. The Minister informed the Members that the gender budget has Rs. 97,134 crore and the child budget Rs. 77, 236 crore in 2013-14.

He said, women belonging to the most vulnerable groups,

including single women and widows, must be able to live with self-esteem and

dignity and added that young women face gender discrimination everywhere,

especially at the work place. Ministry of Women and Child Development has been

asked to design schemes that will address these concerns and a sum of Rs. 200

crore has been provided to begin work in this regard.

The Finance Minister allocated Rs. 3,511 crore to the Ministry of Minority

Affairs, which is an increase of 12 percent over the BE and 60 percent over the

RE of 2012-13. The Maulana Azad Education Foundation is the main vehicle to

implement education schemes and channelized funds to non-government

organisations for the minorities. Its corpus stands at Rs. 750 crore. With the

objective of raising it to Rs. 1500 crore during the 12th Plan period, the

Minister proposed to allocate Rs. 160 crore to the corpus fund. The foundation

wishes to add medical aid to its objectives and the same has been accepted that

a beginning can be made by providing medical facilities such as a resident

doctor in the educational institutions run or funded by the Foundation. Rs. 100

crore is being allocated to launch this initiative. He said, government is

committed to provide support to persons with disabilities and announced a sum of

Rs. 11 0 crore to the Department of Disability Affairs for the ADIP Scheme in

2013-14.

Budget: Concepts and Terminologies

Budget of a government is a comprehensive statement of

government finances relating to a particular year. Every Budget broadly consists

of two parts- (i) Expenditure Budget and (ii) Receipts Budget.

The amounts of intended expenditure by the Government in the next financial year

are expressed in the Expenditure Budget.

The entire Expenditure Budget can be divided into two distinct categories, viz.

(i) Capital Expenditure- those expenditures by the government that lead to an increase in the assets or a reduction in the liabilities of the government. It is however not necessary that the assets created should be productive or they should even be revenue generating. Only the charges towards the construction of the asset are counted as Capital expenditure, while the subsequent charges for its maintenance are considered as Revenue expenditure. Most capital expenditure is non-recurring.

-

Examples of Capital Expenditure causing ‘increase in assets: construction of a new Flyover, Union Govt. giving a Loan to a State Govt.

-

Examples of Capital Expenditure causing ‘reduction of a liability’: Union Govt. repays the principal amount of a loan it had taken in the past.

(ii) Revenue Expenditure- those expenditures by the government that do not affect its asset-liability position. Most kinds of revenue expenditures are seen as recurring expenditures. The entire amount of Grants given by the Union Government to States is reported in the Union Budget as Revenue Expenditure, even though a part of those Grants get utilized by States for building Schools, Hospitals etc. This is so because the ownership of the schools or hospitals built from the Central grants would not be with the Union Government.

-

Examples of Revenue Expenditure are: expenditure on Food Subsidy, Salary of staff, procurement of medicines, procurement of text books, payment of interest, etc

Total government expenditure can also be divided into another set of categories, viz.

(i) Plan Expenditure: Plan expenditure refers to government

expenditure, which is meant for financing the programmes/schemes formulated

under the ongoing/previous Five Year Plan

(ii) Non-Plan Expenditure: Expenditures of the government, which are not

included under the Plan Expenditure are called Non Plan Expenditure. It includes

some of the important types of government expenditure, eg: interest payments,

pension, defence expenditure, spending on law and order, spending on

legislature, subsidies, and salary of regular cadre teachers, doctors and other

government officials.

The Receipts Budget presents the information on how much the Government intends

to collect as its financial resources for meeting its expenditure requirements

and from which sources, in the next fiscal year. This can also be divided into

two categories:

(i) Capital Receipts- those receipts that lead to a reduction in the assets or an increase in the liabilities of the government.

-

Capital Receipts that lead to a ‘reduction in assets’: Recoveries of Loans given by the government and Earnings from Disinvestment;

-

Capital Receipts that lead to an ‘increase in liabilities’: Debt.

(ii) Revenue Receipts- those receipts that don’t affect the asset-liability position of the government. Revenue Receipts comprise proceeds of Taxes (like, Income Tax, Corporation Tax, Customs, Excise, Service Tax, etc.) and Non-tax revenue of the government (like, Interest receipts, Fees/ User Charges, and Dividend & Profits from PSUs).

Government revenue through taxation can be divided into Direct Taxes and Indirect Taxes.

Direct Taxes: Those taxes for which the tax-burden cannot be shifted are called Direct Taxes. Examples of Direct Taxes are:

(i) Corporation Tax: This is a tax levied on the income of registered companies in the country, whether national or foreign, under the Income Tax Act, 1961.

(ii) Personal Income tax: This is a tax on the income of individuals, firms etc. other than Companies, under the Income Tax Act, 1961. This head also includes other Taxes, mainly the ‘Securities Transaction Tax’, which is levied on transaction in listed securities undertaken on stock exchanges and in units of mutual funds.

(iii) Wealth Tax: This is a tax levied on the benefits derived from the ownership of property, under the Wealth Tax Act, 1957. Wealth tax has virtually been abolished in India.

Indirect Taxes: Those taxes for which the tax-burden can be shifted are called Indirect Taxes. Any person, who directly pays this kind of a tax to the Government, need not bear the burden of that particular tax; he/she can ultimately shift the tax- burden to other persons later through business transactions of goods/ services. Indirect tax on any good or service affects the rich and the poor alike! Unlike indirect taxes, direct taxes are linked to the tax-payee’s ability to pay and hence are considered to be progressive. Examples of Indirect Taxes are:

(i) Customs Duties: In this, the taxable component is import

into or export from the country.

(ii) Excise Duties: It is a type of tax levied on those goods, which are

manufactured in the country and are meant for domestic consumption. It is a tax

on manufacturing, which is paid by the manufacturer, but he passes this burden

on to the consumers.

(iii) Sales Tax: It is levied on the sale of a commodity, which is produced

imported and being sold for the first time. If the “Product is sold subsequently

without being processed further, it is exempt from sales tax. Before the

introduction of VAT, sales tax used to be levied under the authority of both

Central Legislation (Central Sales Tax) and State Government’s Legislation

(Sales Tax)

(iv) Service Tax: It is a tax levied on services provided by a person and the

responsibility of payment of the tax is cast on the service provider. However

this tax can be recovered by the service provider from the service receiver in

course of his/her business transactions.

(v) Value Added Tax (VAT): VAT is a multi-stage tax, intended to tax every stage

of sale of a good where some value has been added to the raw materials; but

taxpayers do receive credit for tax already paid on the raw materials in earlier

stages.

Debt and Deficit

A Debt is a kind of receipt that necessarily leads to an increase of the government’s liabilities. The government incurs a Debt only for meeting the gap created by excess of its expenditure over its receipts for that year, which is called Deficit.

Fiscal Deficit

It is the gap between the government’s total Expenditure (including loans net of repayments) and its Total Receipts (excluding new debt to be taken). Thus Fiscal Deficit for a year indicates the borrowing to be made by the government that year.

Revenue Deficit

The gap between Total Revenue Expenditure of the Government and its Total Revenue Receipts is called the Revenue Deficit

Distribution of financial resources between the Centre and the States

A Finance Commission is set up every five years to recommend measures for sharing 0 resources between the Centre and the States, mainly pertaining to the Tax Revenue collected by the Central Government. Presently the recommendations made by the 13th Finance Commission are in effect (from 2010-11 to 2014-15), whereby 32 percent of the shareable divisible pool of Central tax revenue is transferred to States every year and the Centre retains the remaining amount for the Union Budget.

Tax-GDP Ratio

Gross Domestic Product CGDP) is an indicator of the size of a country’s economy. In order to assess the extent of government’s policy interventions in the economy, some of the important fiscal parameters, like, total expenditure by the government, tax revenue, deficit etc. are expressed as a proportion of the GDP. Accordingly, a country’s tax-GDP ratio helps us understand how much tax revenue is being collected by the government as compared to the overall size of the economy. A higher tax to GDP ratio in a country is a positive sign meaning that the government is collecting a decent amount of tax revenue as compared to the size of its economy.

A Power Sector Review of Budget

A Power Sector has to play a key role in the country’s quest for economic growth and a major focus on providing power to all. Indian Power sector has been facing major set of challenges since last year with shortage of fuel and lack of distribution reform. The coal availability has emerged as one of the biggest problems in power sector as can be understood through the fact that there was a 11.6 Billion Units shortfall in power generation during 2011-12 due to shortage of coal (Central Electricity Authority). Gas availability for Indian power sector is also very low.

Therefore, no new projects on gas based generation will be possible before 20 15-16 (as there is a possibility of coming of LNG terminal in western coast only by 2015-16). From the present shortage of fuel, it is very much evident that the country is dependent on more and more of fuel imports. Thus moving towards more imports of coal and gas in line with oil imports, is a major cause for concern as this will further add up to the problem of current account deficit. The fuel shortage problems of power sector needs a long term strategy and therefore would take some time to put the sector back on track. Finance Minister, in his budget (2013-14) proposal for power sector has suggested that we must reduce our dependence on coal imports.

The major announcements for power sector in the budget are as follows:—

-

Financial restructuring of the DISCOMS to restore the health of the power sector and states are advised to quickly to prepare the financial restructuring plans, ‘sign MOU’s and take advantage of the scheme

-

Cabinet Committee on Investment (CCI) to be consulted in taking up decisions in oil/power/coal projects

-

Rs. 800 crores allocated for Ministry of New and Renewable Energy, so Wind Power Sector heaves a sigh of relief

-

Tax holiday for power plants extended for one more year up to March, 2014

-

Wind energy sector to get generation based incentives

-

To encourage states to take up waste to energy (WTE) projects via PPP mode

-

Rs. 5280 crores allocated to Department of Energy

-

Current Account Deficit still high - one of the main reasons is high import of coal

-

Coal import in April-December, 2012 at 100 million tonnes, to rise to 185 million tonnes in 2013-14

-

For increasing coal supply, PPP projects along with Coal India has been announced

-

Oil and Gas policy to be announced

-

The recent buzz word in USA is Shale Gas for future energy needs. So it is a welcome move that Govt. of India will announce Shale Gas policy soon

-

Oil and Gas blocks under National Exploration Licensing Policy (NELP) to be cleared this year

-

Natural Gas Pricing Policy to be reviewed - to benefit the gas companies

-

Five LNG terminals Dabhol in Ratnagiri district of Maharastra will be operational in 2013-14

-

Rate of Withholding tax on interest payments on ECB is proposed to be reduced from 20 to 5 percent which will benefit power sector also

-

Duties have been equalized on steam and bituminous coal used for generation. Now both would attract 2 percent customs and 2 percent countervailing duty (CVD).

This customs duty and CVD will push up the coal prices and generation costs and widen the price differential with domestic coal fired power.

Extension of the sunset clause for availing ten year tax holiday for a year would benefit approximately 20 Giga Watts of capacities to be commissioned in 2013-14. The extension would drive promoters to complete ongoing projects quickly and this may attract fresh investment. Funding will also improve with the issuance of tax-free bonds of Rs. 50,000 crores and credit enhancement through IIFCL.

The proposal to adopt a PPP framework for coal production will improve domestic supply of coal in the long term. Custom duty on imported coal, which was previously exempt, has been increased to two percent while countervailing duty has also been raised to two percent. Further the Railway budget hiked freight rates by 5.8 percent. Consequently, generation costs will increase per unit for coal- based projects.

Introduction of 2 percent customs duty and 2 percent CVD will have an impact on the price of imported coal and on the cost of power generation and is expected to increase the tariff. The upshot is that around 60 to 70 percent coal imported earlier for thermal power plants was exempt from any customs duty. Now this category of coal will see a rise in costs of imports and resulting rise in cost of generation.

Changes in duties on coal, railway tariffs and other costs will raise generation cost by 20 paise per unit and much higher in states where power utilities are making losses. The hike would be steepest where utilities are reeling under losses. Moreover the states which will be adopting financial restructuring package burdened with heavy losses, have to announce tariff hike as one of the conditions for restructuring.

For the first time budget has made provision for waste- to- energy (WTE) projects via PPP mode. This will be supported through different instruments like viability gap funding (VGF), repayable grant and low cost capital. A debate has started on the suitability of such projects as environmentalists are of the opinion that these projects and technologies are not suitable for India. Though Municipal bodies say it is the most effective way to manage waste and this may encourage private players as there is provision for VGP. Delhi has such plant of 16 MW capacity at Okhla and other two projects will be operational at Gazipur and Narela -Bawana by this year end. WTE projects are the only way to dispose waste in the metro cities.

As per the budget estimate, coal imports during the period April-December, 2012 have crossed 100 million tones. It is estimated that import will rise to 185 million tonnes in 2016-17. If the coal requirements of the existing power plants and the power plants that will come into operation by 31.03.2015 are taken into account, there is no alternative except to import coal and adopt a policy of blending and pooled pricing. Finance Minister has suggested that in the medium and long term, we must reduce our dependence on coal imports. This can be achieved through devising a PPP policy framework with Coal India Limited (CIL) in order to increase the production of coal for supply to power producers. These matters are under active consideration and Minister of Coal will announce Government’s policies in due course.

There was a mis- classification between steam and bituminous coal as both are used in thermal power plants. The steam coal was exempt from customs duty but attracts a CVD of one percent. Bituminous coal attracted a duty of 5 percent and a CVD of 6 percent. The budget proposed to equalize the duties on both kinds of coal and levy 2 percent customs duty and 2 percent CVD to avoid these mis-classification.

Since there is change in coal pricing policies of different countries mainly Indonesia and Australia, the Indian import price of coal has increased. All the power producing companies who have signed a long term power purchase agreements with various utilities, now want revision of price due to this change in imported coal price. But no clear policy has been declared as yet by Central or State Govt. in this regard.

So power plants based on imported coal are operating at under capacity. Now Indian power producers are looking for imported coal from politically stabilsed south East African countries like Mozambique and Botswana other than South Africa as new source.

Agriculture and Budget

Huge Food grains stocks and rising exports of India’s agricultural goods, the Union’ Budget presentation for 2013-14 would not have come at a better time for the sector which employs more than half of country’s working class population.

As Finance Minister P Chidambaram rose to present the un ion budget for the year 2013-14, there was lot of expectation from the farming community. Nothing explains the agriculture sector better than the Economic Survey 2012-13 presented before the Parliament just a day before the union budget was announced. The survey observed “Indian agriculture is broadly a story of success. It has done remarkably well in terms of output growth, despite weather and price shocks in the past few years”.

The Eleventh Five Year Plan (2007-12) agricultural and allied sector witnessed an average annual growth of 3.6 percent in the gross domestic product (GDP) against a target of 4.0 percent. While it may appear that the performance of the agriculture and allied sector has fallen short of the target, production has improved remarkably, growing twice as fast as population. “India’s agricultural exports are booming at a time when many other leading producers are experiencing difficulties,” the survey which is an annual report card of government’s performance noted.

At a nutshell, India is the first in the world in terms of production of milk, pulses, jute and jute-like fibres, second in rice, wheat, sugarcane, groundnut, vegetables, fruits and cotton production, and is a key producer of spices and plantation crops as well as livestock, fisheries and poultry sector.

Prior to announcing the budget measures, Chidambaram said, “thanks to our hard working farmers, agriculture continues to perform very well. The average annual growth rate of agriculture and allied sector during the 11th Plan was 3.6 percent as against 2.5 percent and 2.4 percent, respectively, in the 9th and 10th Plans”.

He noted in 2012-13, total foodgrain production will be over 250 million tonnes. “Minimum support price of every agricultural produce under the procurement programme has been increased significantly. Farmers have responded to the price signals and produced more. Agricultural exports from April to December, 2012 have crossed Rs 138,403 crore,” Chidambaram noted. Though government constantly focuses on increasing exports of manufactured goods and services, according to a recent paper written by the Commission for Agricultural Costs and Prices (CACP) chief Ashok Gulati and others, its off-on policy on agricultural exports is preventing the country for achieving its potential.

“If the government is proactive, FY’12 exports can cross $42- 43 billion”, Gulati says. In 2011-12, according to Gulati, agricultural exports by India were more than $37 billion against an import of commodities worth around $17 billion. India has emerged as the world’s largest exporter of rice, replacing Thailand and Vietnam and the country has also the biggest exporter of buffalo meat beating traditionally strong countries such as Brazil, Australia and the US.

CACP research paper titled ‘Farm trade: Tapping the hidden potential’ has stated that agricultural exports have increased more than 10 fold from $3.5 billion in 1990-91 to $37.1 billion in 2011-12. “This share is more than the share that India has in global merchandise exports,” the paper has noted.

The agriculture sector which employs more than 55% of the country workforce stands at a cross roads. Measures taken by the government during next few years would decide the shape the agriculture sector would take. As the latest Economic survey points out that “India is at a juncture where further reforms are urgently required to achieve greater efficiency and productivity in agriculture for sustaining growth. There is need to have stable and consistent policies where markets playa deserving role and private investment in infrastructure is stepped up. An efficient supply chain that firmly establishes the linkage between retail demand and the farmer will be important”.

The survey also points out that rationalization of agricultural incentives and strengthening of food price management will also help, together with a predictable trade policy for agriculture. These initiatives need to be coupled with skill development and better research and development in this sector along with improved delivery of credit, seeds, risk management tools, -and other inputs ensuring sustainable and climate-resilient agricultural practices. One of the key proposal announced by Finance Minister P Chidambaram in his budget speech includes close to 22% jump in the agriculture credit target for the next fiscal besides granting similar hike in allocation for the agriculture ministry.

“Agricultural credit is a driver of agricultural production. We will exceed the target of Rs 5,75,000 crore fixed for 2012-13. For 2013-14, I propose to increase the target to Rs 7,00,000 crore,” Chidambaram said while presenting the Budget for the 2013-14.

The finance minister also announced continuance of the interest-subvention for short-term crop loan. Farmers who repay loan on time will be able to get credit at 4% interest per annum. He also announced extension of crop loan scheme to private sector banks along with the loan extended by public sector banks, Regional Rural Banks and cooperative banks.

“So far, the scheme has been applied to loans extended by public sector banks, Regional Rural Banks and cooperative banks, I propose to extend the scheme to crop loans borrowed from private sector banks and scheduled commercial banks in respect to loans given within the service area of the branch concerned,” Chidambaram announced.

Similarly, another thrust of the finance minister’s budget proposal was 22% increase in financial grant for the agriculture ministry to Rs 27,049 crore for the next fiscal in comparison to last year. The hike in allocation also includes Rs 3,415 crore earmarked for agricultural research.

Another key proposal announced by the finance minister include a Rs 1000 crore allocation under the Bringing Green Revolution in the Eastern India (BGREI) for the next fiscal. For augmenting rice production in states including Assam, Odisha, Jharkhand and West Bengal, the government had allocated Rs 400 crore in 2011-12 and Rs 1000 crore during the current fiscal. “The original Green Revolution States face the problem of stagnating yields and over-exploitation of water resources. The answer lies in crop diversification.

Gender Issues: Budget Proposals

The Union Budget 2013-14 is realistic, woman-centric, shorn of fanfare and attuned to the harsh global and domestic economic realities. The backdrop remains challenging - hesitant global growth, persisting problems in the Euro zone, high oil prices, high domestic inflation, current account and fiscal imbalances and a sharp slowdown in the industrial sector.

There are no dramatic initiatives. Rather, it is about staying the course. There are no overt negative or regressive measures. The budget strikes the right balance between the often conflicting demands of fiscal rectitude, inflation, growth and inclusion. The Finance Minister has sent the right signals as regards the future course of reforms. He has also unequivocally articulated his commitment to restoring trust and confidence among entrepreneurs and investors and reducing the obstacles to doing business in India. At a time when business confidence needs to be revived, this is indeed reassuring.

The woman-centric budget, presented by Union Finance Minister, P. Chidambaram in the Lok Sabha gave enough reasons for Indian woman to smile. The gender budget has Rs. 97,134 crore and the child budget has Rs. 77,236 crore in 2013-14.

As a huge step towards empowerment of women, the government proposed to set up the country’s first women’s bank as a public sector bank. The Finance Minister will provide 1,000 crore as initial capital. He hopes to obtain the necessary approvals and the banking licence by October 2013.

Mr. Chidambaram said women were at the head of many banks today, including two public sector banks, but there was no bank that exclusively served women. The Budget 2013-14 has provided for setting up a bank that lends mostly to women and women-run businesses, that supports women Self Help Groups and women’s livelihood, that employs predominantly women, and that addresses gender related aspects of empowerment and financial inclusion.

Research has shown that women, specially rural women, were not confident of making financial decisions. They would feel more confident if they could walk into a bank where people would listen and empathise with them. The PSU bank will be good because it will help women make their own decisions. Research says women are more comfortable with women managers or advisors. Also, a bank run by women means they can go there without a male member of the family.

Of the three big promises made by Mr. Chidambaram in his budget proposals for 2013-14, the first was the “collective responsibility to ensure the safety and dignity of women.” Towards this end, the government announced a proposal to set up a NIRBHAYA FUND with an allocation of Rs. 1,000 crore. Union Women and Child Development Minister and other Ministers concerned will work out the details of all structure, scope and application of the Fund.

Referring to the horrific case of gang rape and murder of a young woman in the National Capital in December, Mr. Chidambaram said recent incidents had cast a long dark shadow on our liberal and progressive credentials.

“As more women enter public spaces - for education or work or access to services or leisure - there are more reports of violence against them. We stand in solidarity with our girl children and women. And we pledge to do everything possible to empower them and to keep them safe and secure,” the Finance Minister said, adding that a number of initiatives were under way and many more would be taken by government as well as non-government organisations.

Saying these deserved government support, Mr. Chidambaram announced the NIRBHAYA FUND, named after the gang rape victim.

Pointing out that women belonging to the most vulnerable groups, including single women and widows, must be able to live with self-esteem and dignity, the Minister said young women faced gender discrimination everywhere, especially at the work place. The Ministry of Women and Child Development has been asked to design schemes that wi11 address these concerns. “I propose to provide an additional sum of Rs. 200 crore to the Ministry to begin work in this regard,” he said.

Another small proposal in the gender budget is that it has raised the maximum amount of jewellery that may be brought home by Indian women who have lived abroad for more than a year or who are changing residence from Rs. 20,000 to Rs. 1,00,000 A scheme for maternal and child malnutrition for the 100 poorest districts with an allocation of Rs. 300 crores is also envisaged. The budget has substantially increased allocations to schemes that allow for direct cash transfers to women and young Indians. The Indira Gandhi Matritva Sahyog Yojana (IGMSY) that envisages providing cash assistance directly to pregnant and lactating women has seen its budget allocation for the coming year going up to almost five times the Revised Estimate for the current year.

The 2013-14 budget is, in fact, a good one, aiming to improve the economy with strong focus on infrastructure and rural development and with stress on women, youth and the poor, who constitute a majority of the population.

Procedures for Foreign Portfolio Investors Simplified

Terming the Indian markets as amongst the best regulated the Finance Minister announced several measures to strengthen the capital market regulator SEBI on the eve of its Silver Jubilee. The Depository Participants authorized by SEBI will now register different classes of portfolio investors subject to compliance with KYC guidelines doing away with different procedures and avenues for many categories. SEBI will simplify the procedure for the Foreign Portfolio Investors and prescribe uniform registration and other norms by converging the different KYC norms. In order to remove the ambiguity between FDI and FII in accordance with international practices, an investor with a stake of 10% or less will be treated as FH whereas the one with more than 10% stake will be treated as FDT. The FIIs will also be permitted to participate in exchange traded Currency Derivatives segments to the extent of their Indian rupee exposure in India. FIls will also be permitted to use their investments in Corporate Bonds and Government Securities as collateral to meet their margin requirements.

Angel investors provide both experience and capital to new ventures. SEBI will prescribe requirements for angel investor pools by which they can be recognized as category I venture funds. With the objective of developing the debt market, stock exchanges will be allowed to introduce a debt segment on the exchange wherein banks and primary dealers will be trading members alongwith insurance companies, provident funds and pension funds. The list of eligible securities in which Pension Funds and Provident Funds may invest will be enlarged to include exchange traded funds, debt mutual funds and asset backed securities.

Highlights of the Economic Survey 2012-13

-

Economic growth pegged at 6.1-6.7 percent in 2013-14

-

March 2013 inflation estimated at 6.2-6.6 per cent

-

Priority will be to rein in high inflation

-

FDI in retail to pave the way for investment in new technology and marketing of agriculture produce

-

Survey calls for widening of tax base and prioritising expenditure to bridge fiscal deficit

-

Calls for curbing gold imports to contain current account deficit

-

Aadhaar-based direct cash transfer scheme can help plug leakages in subsidies

-

With subsidies bill increasing, danger of missing fiscal targets is real in FY13

-

Survey pitches for hike in prices of diesel and LPG to cut subsidy burden.

-

Foreign Exchange reserves remains steady at $295.6 billion at December,2012-end

-

At present, overall energy deficit is about 8.6 percent and peak shortage of power is about 9 per cent.

-

Infrastructure bottlenecks affecting industrial sector performance

-

Prospects for world trade as well as of India are still uncertain.

-

Pitches for further opening of sectors for FDI

Public Private Partnership (PPPs): Analysing the Factors behind their Growth

The Term Public Private Partnership’ or ‘PPP’ has become a buzzword of late in the policy circles, and is being increasingly resorted to as a preferred medium for provisioning of public services both within the industrialised and low-income countries. While the PPPs are more commonly found in the transport infrastructure sector, such as roads, airports, and ports (primarily due to the commercial pricing models), they are also invoked in water supply and sanitation, tourism, education, health, and other social sector programmes, albeit to a lesser degree. A significant difference is however observed in the nature of PPPs across these sectors. In many cases they appear to be glorified forms of service level agreements rather than ‘partnerships’ as are defined in the normative literature on PPPs.

Engagement with the private sector for provisioning of infrastructure facilities has become increasingly popular in the past few decades. India too has joined the bandwagon of countries adopting PPPs for delivery of services under various infrastructure sectors. It is claimed that India has the maximum number of projects within PPP in the transport sector. Its experience in highways and expressways has been substantial. All national highways in the present phase of NHDP (National Highways Development Programme) are being implemented within PPP mode. Recently, the empowered Group of Ministers on infrastructure has decided that 95% of road projects in the current year will be through PPP.

Several airports are being built with private sector

participation, while some metro-rail projects, such as the Hyderabad metro, are

also opting for this approach rather than the traditional way of public sector

delivery. According to the Economic Survey 2010-2011, against a target of 30% of

private sector participation in infrastructure sector, the achieved figure was

34%. An investment of USD 1 trillion has been envisaged for infrastructure

during the 12th Plan: of this USD 500 billion is expected to be contributed by

the private sector. These figures demonstrate the primacy given to private

sector participation at the policy level.

Against this background, this article attempts to provide theoretical insights

into the concept of PPP, and analyses the reasons for its growth and acceptance

as a mode of service delivery in many countries.

Growth of PPPs

There have been instances of the State engaging with the private sector towards provisioning of public services throughout the known history the case of Mathew private tax-collector from the Bible; public street lamps in 18th century England were cleaned by private contractors; the rail companies of 19th century England and the US were privately owned; 82% of Sir Frances Drakes fleet of 197 vessels, which conquered the Spanish armada, were owned by contractors. Toll roads and toll bridges, privately owned and operated, has been around since antiquity. Toll roads carry mention in writings of the Greek historian and philosopher Strabo (63 BC-AD 21) in Geographia during the time of Caesar Augustus, where he records existence of tolls on the Little Saint Barnard Pass. Historical development of PPPs in infrastructure had its beginning in Europe in the demand for mass travel and long distance commerce in second half of 17th century. France pioneered the concession type model in 17th century which was extensively used in the 19th century to finance and develop public infrastructure.

However, Public Private Partnerships as are known in their current form started in the Organisation for Economic Co-operation and Development (OECD) countries and the USA. These gradually spread to the low-income countries. Reliance on PPPs as a preferred mode of service delivery rose to significant proportions during the 1990s, peaking around 1997. Governments under Presidents Carter and Reagan in the USA and Margaret Thatcher in UK promoted wide range of partnerships at all levels of the State. Among all the countries adopting PPPs, UK has had the maximum number of projects implemented under the Public Finance Initiative (PFI) initiated in 1992. PPPs have been now included in legislation in many countries such as the urban policy legislation of UK and USA, industrial policies of France, and economic development policies of Italy, Netherlands and UK. While Netherlands Australia, Hungary, Italy, Japan: Korea, Spain and France have had substantial experience in implementing infrastructure projects under PPP, countries like Chile, Brazil, Singapore, India, and Canada are actively exploring this mode of delivery of public services. PPPs form the core of European Union (EU) initiatives for economic competitiveness and are the preferred framework for development of trans-European transportation. Recently the European Commission has advocated greater use of PPPs for provisioning of infrastructural services and bringing in innovation in service delivery.

Understanding the Context of PPPs

Different definitions and interpretations have been associated with the term Public- Private Partnerships. These depend upon the context within which they are initiated and operated. Simply put, the term PPP traditionally implies engaging with the private sector for provisioning of public services and infrastructure such as roads, airports, ports, health services, garbage and waste management. Such services have been historically provided by the government through public works agencies. According to some, PPP is a framework for describing all cooperative ventures between the State and the non-State agencies, both for profit and not-for-profit. Within the limited context of transport infrastructure sector, PPP is defined as a long term collaborative effort between the government and private agencies, wherein both pool in their differentiated and specialised resources for planning, design, construction operation and maintenance of infrastructure services. They also share investments, risks, benefits and responsibilities. This feature of the PPP has been argued to form the crux of the partnership. The facility thus developed eventually reverts back to the government after expiry of the concession period. In India this period ranges from 20 to 30 years.

A common misconception about PPPs is that they involve the private sector merely for financial partnering. However, PPPs are more about a service procurement policy rather than a capital asset management policy; they do not do away with public investment but merely supplement it. Within a PPP the private partner is involved in a broader ambit of ‘infrastructure investment’ where neither the private sector nor the government is the only owner.

PPPs are perceived to provide public services more efficiently than what the government could accomplish on its own. In the classical literature on public administration, there is a distinct divide between the roles and responsibilities between the State and the private sector, often termed as ‘the market’. While some works were to be taken up by the government agencies due to their social and economic mandate, some services were delivered by the agencies. However, the traditional conceptualisation of the state being the sole provider of services and goods for public welfare came under severe strain in the decades since 1970s. In the 1970s and 1980s, as the demand for public infrastructure grew and governments became increasingly fund starved, due to deficit financing and populist pressures to hold prices below costs, their capacity to provide sufficient and quality infrastructure was found to be inadequate. The public utilities were therefore largely neglected.

In most of the developing low-income countries it was found that public finance for infrastructure was generally inadequate and full cost recovery of infrastructure charges was becoming more of an exception than a rule. In addition to poor allocation of funds for development of infrastructure, maintenance got even little, which was assumed to be funded by future budgets which were typically insufficient. Traditional methods also left a number of risks with the public sector, regarding the asset ownership. This is attributed to its monopoly position with no incentive for competition, poor fiscal discipline and limited fiscal autonomy to public bodies and managerial inefficiency which increases production cost. Many governments attempted to improve performance through corporatisation and performance contracts which were largely unsuccessful.

Social Sector Outlays–As Assessment

As Country’s most important resource are its people”, Finance Minister P Chidambaram said quoting Joseph Stiglitz, and through his Budget speech the finance minister spoke of the need to pay “special attention” to the sections that had been left behind. Yet when it came to making good on the talk, the government fell short. Social sector-education, health, sanitation, welfare, rural development-allocations in Budget 2013-14 fails to convince anyone that the government is seized of the importance and urgent need to invest in the people.

This year, the total budget outlay for the social sector, excluding in the non-Plan spending, saw a modest increase in its share of the GDP-from 1.7% in 2012-13 revised estimates to 1.9% in 2013-14 budget estimates. Going by past records, it is likely that total social sector spending will see a downward revision by the time the 2013-14 revised estimates are worked out.

In its Twelfth Plan document, the government has stated its intention to raise public expenditure to 2.5 per cent of GDP by 2017, when the plan period comes to a close. Budget 2013-14 appears to do little to achieve this goal. Spend on health accounts for 2.24 percent of the Budget. Extreme under provisioning for health has somewhat become a standard. Centre’s total expenditure on health as a proportion of GDP has only marginally increased from 0.25 percent in 2003-04 to 0.33 percent in 2013-14. For a country with a vast population, and a high level of people who can be adjudged as poor, such paltry spending on health is a cause of senous concern.

The country’s total expenditure on health amounts to about 5 per cent of GDP, which would be comparable with other developing countries at the same level of per capita income. The lion share of the spending on health is borne by private households’ out of pocket expenditure, roughly between 70 to 80 per cent of total expenditure on health care. The low level of public spending means that a large part of the expenditure on health is borne by households from their private resources—income and savings. This is affects the poor most adversely. The low spend on health has serious repercussions. A study in Indian poverty by Anirudh Krishna of Duke University found that rural expenditure on health is the primary reason for families decline into poverty. The inability to spend on health and the debts incurred for it are factors that push families into poverty.

The low level of funds for public health is an indicator for another pillar of the government’s “sustainable and sustained” growth aim. Environment is a key public health concern. The lack of investment in public health rollout whether it is through key programmes or health infrastructure will also hinder the need for greater environmental accountability from the people. Unlike last year there has been no windfall for sanitation, this would further hamper efforts to improve public health.

Many will argue that social sector’s demand for higher

allocations is something of a fetish. It will be argued that budgetary

allocation for the social sector increased from Rs 39,123 crore in 2004-05 to Rs

2,13,689 crore in 2013-14. And that public spending (both centre and state) in

the social sector increased from 5.3 per cent of GOP in 2004-05 to 6.7 percent

in 2011-12, and is around 7 percent of GOP in 2013-14. While that might appear

impressive, the fact is that between 2001 and 2011, India added as many as 1.81

crore persons to its population, and this number is likely to have gone up the

last few years. Another fact that needs to be kept in mind is that this spending

of Rs 2,13,689 crore accounts for expenditure on education, youth affairs and

sports, art& culture, health & family welfare, water supply and sanitation,

housing and urban development, information and broadcasting, welfare of

scheduled castes, scheduled tribes, and other backward classes, labour and

labour welfare, social welfare and nutrition, women and child development and

other social services.

India’s spending on social sector, given the magnitude of the need, has been

consistently low. After adjusting for inflation and taking into account existing

deficiencies in the social sector, it becomes clear that budgetary allocations

for key areas such as education, health, sanitation, nutrition, rural

development has not gone up over the last few years. The average social sector

spending in developed countries is to the tune of 14% of GDP.

In budget 2013-14, the two key development indicators-education and health-did

not fare too well. Total central government allocation for education is at 0.70

percent of the GDP, marginally up from 0.67 percent in 2012-13 (revised

estimates) and down from 0.74 percent in last year’s budget. The spend on health

is a cause for concern-this year the health budget increased by only Rs 2,842

crore over last year’s budget estimates. Central government spend on health is

at 0.33 percent of GDP compared to 0.29 percent in 2012-13 revised estimates and

down from 0.34 percent in the budget estimate for 2012-13. The marginal increase

in allocation is far too small to address the large need in the two crucial

sectors.

An important issue with direct feedback effect on health-drinking water and sanitation- saw a modest hike of Rs 2,260 crore in budgetary allocations over the 2012-13 revised estimate of Rs 13,005.3 crore. The increased allocation is nowhere what is required-only 43.5 percent of the population gets tap water supply and 53.1 percent of households have no access to toilets and defecate in the open. The health hazard-both in the short and long-term-that this situation presents is far from being addressed. Given the state of healthcare, with its overdependence on private out of pocket expenditure by households, the lack of basic sanitation presents a serious problem. Not only does it contribute to rural indebtedness, but affects the productivity of human capital so central for sustained economic growth.

There has been no move towards the promised 6 percent of GDP for education; total public spending is yet to cross the 3.7 percent mark. According to the Economic Survey, outlays on education was at 3.31 percent of GDP in the 2012-13 budget estimates. Given the downward revision, the outlay is about 3.2 percent of GDP. Finance minister P Chidambaram provided for Rs 27,258 crore for implementing the Right to Education through the Sarva Shiksha Abhiyan. Allocation is up by 6.6 percent over 25,555 crore provided last year, which had been revised to Rs 23,645 crore. This year’s budgetary allocation is nowhere near the Rs 39,115 crore that ministry for human resource development had sought.