(Sample Material) Online Coaching for Contemporary Issues of GS: Economic & Social Development (Across the Aisle Cut in Repo Rate)

(Sample Material) Online Coaching for Contemporary Issues of GS: Economic & Social Development (Across the Aisle| Cut in Repo Rate:)

Now, do the Heavy Lifting

To understand the RBI’s cautious moves, one must understand Dr Raghuram Rajan.

As they say, it is “done and dusted”. The Reserve Bank of India (RBI) finally met the expectations of the Government, business and a number of economists and cut the repo rate by 50 basis points. The Governor, Dr Raghuram Rajan, was hailed as a hero. He would have been hailed as a hero even if the RBI had cut the repo rate by 25 basis points or not made a cut at all. There are enough economists who would have supported either decision. Bankers would have anyway supported any decision; the RBI is their regulator!

All this is not to be understood as criticism of RBI’s decision. I think it was the right decision, and I immediately welcomed it. I also felt that it was long overdue — at least by two to four quarters —and the delay may have cost quite a bit of growth.

To understand the RBI’s cautious moves, one must understand Dr Rajan. He is an intellectual powerhouse, a tenured professor at the University of Chicago and the author of several path-breaking books. Independent, orthodox and cautious are the words that best describe him.

Mr Rajan believes that price stability is the main objective of monetary policy. He would know that inflation targeting is not done as much by changing rates as by managing inflation expectations by signalling to the market that the central bank is committed to a certain path. He would also know that small changes in the interest rate usually do not have a significant impact on inflation unless inflation expectations are anchored.

With this background, let us consider how well the RBI has conducted monetary policy in the last 24 months.

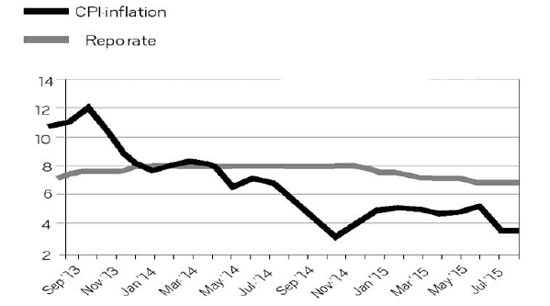

The graph (left) shows year-on-year Consumer Price Index (CPI) inflation and the repo rate since September 2013. While reading the graph, please remember that the RBI had, in its monetary policy statements of 2014, set the target of inflation at 8 per cent by January 2015 and 6 per cent by January 2016.

To its credit, the Government remained committed to the path of fiscal consolidation announced in 2012 following the report of the Vijay Kelkar committee. The fiscal deficit was to be contained according to the following time table:

March 2013: 5.2 per cent

March 2014: 4.8 per cent

March 2015: 4.2 per cent

March 2016: 3.6 per cent

March 2017: 3.0 per cent

Fiscal Consolidation on Track

In each year up to March 2015, both under the UPA and NDA, we have done better than the target.

And then came the oil and commodities bonanza. The collapse of prices made the Government’s job easier. It could expand public expenditure and at the same time achieve the fiscal deficit targets.

Formulating Monetary Policy

Now, let’s read the graph closely. Inflation peaked in November 2013. Since then it has fallen dramatically. Between November 2013 and May 2014 (the UPA period), CPI inflation declined from 12.2 per cent to 8.3 per cent. Between May 2014 and August 2015 (the NDA period), CPI inflation declined from 8.3 per cent to 3.7 per cent. In the process, the RBI’s target of 8 per cent by January 2015 was easily achieved and, I am confident, the target of 6 per cent by January 2016 will also be achieved.

Contrast this with the repo rate decisions during the period. Till January 2014, interest rates were increased in small steps of 25 basis points. Through 2014, the repo rate was held unchanged at 8 per cent when there was a steep decline in inflation. However, Dr Rajan did three rate cuts in 2015 when inflation was more or less constant. RBI’s actions were contrarian. RBI expected inflation to rise after June 2015; in hindsight, it appears that RBI’s inflation forecasts were flawed.

One could argue that if the inflation forecasts had been more

accurate, the cuts could have been deeper and sooner. That would have improved

liquidity, boosted consumption, and given confidence to investors.

Formulating monetary policy is a complex exercise. It requires making difficult

judgments based on limited (and often unreliable) data. The burden is too much

on one individual, however exceptionally qualified he or she may be. Hence the

need for a Monetary Policy Committee. I have pleaded for an MPC with equal

representation for the Government and the RBI and a casting vote for the

Governor. Despite Dr Rajan hinting that an agreement has been arrived at, the

Government has not announced the MPC. Decision-making in the NDA regime remains

‘a riddle wrapped in a mystery inside an enigma’.

Heavy Lifting Ahead

The cut in the repo rate is not the end of policy making; it gives the Government an opportunity to take bold decisions. Over the next few months, it is the Government that must do the heavy lifting: persuade domestic investors to invest; get the promised FDI; resolve the new tax issues that have cropped up post May 2014; lift the production of coal, steel, oil, natural gas and electricity; quicken the pace of building infrastructure in roads, railways and ports; and pass the GST and other Bills by reaching out to the Opposition. Above all, it must not allow fanatics and eccentrics to set the agenda and raise irrelevant issues that distract us from the work of development.