Fifteenth Finance Commission : Important Topics for UPSC Exams

Fifteenth Finance Commission : Important Topics for UPSC Exams

News:

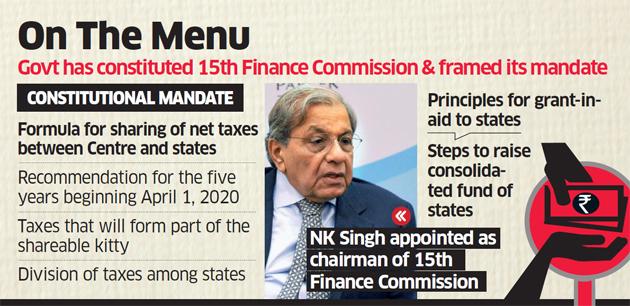

The 15th Finance Commission was constituted on November 27, 2017 and is headed by former Revenue Secretary and former Rajya Sabha MP N.K. Singh. The terms of reference (ToR) of the Fifteenth Finance Commission have raised some questions

Background Information

1. The Finance Commission is a constitutional body created by the President of India under Article 280 of the Constitution of India

2. It is touted as balancing wheel of fiscal federalism in India.

3. The provision of setting up Finance commission in the constitution was an original one and was not borrowed.

4. Article 280 of the constitution lays down following provisions with respect to finance commission

(a) The President shall, within two years from the commencement of this Constitution and thereafter at the expiration of every fifth year or at such earlier time as the President considers necessary, by order constitute a Finance Commission which shall consist of a Chairman and four other members to be appointed by the President

(b) It shall be the duty of the Commission to make recommendations to the President as to

- the distribution between the Union and the States of the net proceeds of taxes which are to be, or may be, divided between them and the allocation between the States of the respective shares of such proceeds

- The principles which should govern the grants in aid of the revenues of the States out of the Consolidated Fund of India.

- The measures needed to augment the Consolidated Fund of a State to supplement the resources of the Panchayats and municipalities in the State on the basis of the recommendations made by the Finance Commission of the State

- Any other matter referred to the Commission by the President in the interests of sound finance

- The Commission shall determine their procedure and shall have such powers in the performance of their functions as Parliament may by law confer on them

5. The recommendations made by the Finance Commission are advisory in nature and, hence, not binding on the Government

6. Finance commission (miscellaneous provisions) act 1951 was passed to give a structured format to the finance commission. It lays down qualifications of the members of commission, terms, eligibility and powers.

- The Chairman of a finance commission is selected from people with experience of public affairs

- The other four members are selected from people who:

- Are, or have been, or are qualified, as judges of a high court,

- Have knowledge of government finances or accounts, or

- Have had experience in administration and financial expertise; or

- Have special knowledge of economics.

Buy Printed Complete Study Materials for UPSC IAS PRELIMS Exam

Online Crash Course for UPSC PRE Exam

7. The commission has all powers of a civil court as per the Civil Procedure Code

Terms of reference of Fifteenth Finance commission and recent controversy

1. Commission shall use the population data of 2011 while making its recommendations :

For the purpose of all the areas where population is taken into account as per constitution 1971 census was being followed up till now.

1971 Census figures showed a dramatic increase in population, after which the concept of family planning was introduced at the policy level, according to research. This meant that States that complied with policy would lose out on all the areas where population was taken into account. Hence, the 42nd Amendment picked the 1971 Census as the base for all calculations and froze it till the 2001 Census. The 84th Amendment further extended that to the first Census after 2026, which will be the Census of 2031.

While States like Uttar Pradesh, Maharashtra and Bihar have more than doubled their numbers in the intervening years, southern states like Tamil Nadu, Karnataka and Kerala have relatively slower growths.

The argument which was valid for freezing the population survey for the matter of seats in lok sabha and legislative assembly hold good for the terms of reference of finance commission too. This means States that have done relatively better to control population growth could see their allocations, as a fraction of the total resources, reduced.

2. Examine whether revenue deficit grants be provided at all: If the Commission takes this suggestion seriously, it will have serious ramifications for States with genuinely large resource gaps.

3. The commission has also been asked to review the recommendations of the previous Commission on the grounds that it gave “substantially enhanced devolution

Nudging the Commission to leave larger fiscal space for implementing national development programmes under New India 2022 is to ask it to leave more funds for making further intrusions into State subjects. The ToR seek to reduce the role of Article 275, which is a legitimate channel for grants, and asks the Commission to leave it more fiscal space to expand grants under Article 282, which is questionable.

4. Commission to take into account the performances in implementation of various Central schemes : This is also contentious : The Seventh Schedule of the Constitution assigns the respective functions in terms of Union, State and Concurrent subjects. It is ironical that the Union government has been intruding into State subjects through Central schemes by forcibly using fiscal space. Performances must be built into the implementation of schemes and not into the tax devolution formula. It must be noted that devolution of taxes to States is not a charity; it is their right.

Counter Arguments:

- The 14th Finance Commission had also given a 10% weightage for the 2011 Census in its calculations and there was no discernible impact on allocations to the more populous States such as Uttar Pradesh and Bihar.

- There are other States whose share of India’s total population has declined between 1971 and 2011, including West Bengal, Goa, Himachal Pradesh and Punjab.

- It is misleading for State governments to assume that all positive changes in demographics are a result of their own actions or policies

NOTE:

According to the Constitution, there are four areas in which population is used as a factor

- Manner of Election of President (Article 55),

- Composition of the House of the People (Article 81),

- Composition of the Legislative Assemblies (Article 170) and

- Reservation of seats for Scheduled Castes and Scheduled Tribes in the Legislative Assemblies of the States (Article 330).

MODEL QUESTIONS

Prelims Questions

1.Refer the following statements about Finance commission

A. The constitution prescribes the qualification of the members of Finance commission.

B. The recommendations of the finance commission are binding on the government.

Choose the correct answer

(a) A only

(b) B only

(c) A and B

(d) None of the above

Correct Answer: d

2.Refer the following statements about Finance commission

A. The Chairman of a finance commission is selected from people with experience of public affairs.

B. Finance commission is a 6 member body.

C. It is also required to make recommendations regarding augmenting the consolidated fund of the states to augment the resources of local bodies.

Choose the correct answer

(a) A and B only

(b) A and C only

(c) B and C only

(d) All of the above

Correct Answer: b