(Download) Yojana Magazine Free PDF Archive : February-2017

(Download) Yojana Magazine Free PDF Archive : February-2017

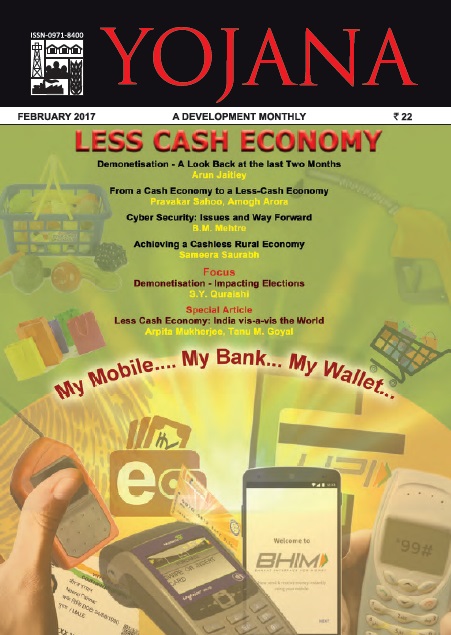

CONTENTS

- Demonetisation – A Look Back at the

- last Two Months

- Arun Jaitley - 7

Do you know? - 9

- From a Cash Economy to a Less-Cash Economy

- Pravakar Sahoo, Amogh Arora - 11

Focus

- Demonetisation - Impacting elections

- S Y Quraishi - 16

NORTH EAST DIARY - 19

- Less Cash Economy: Impact on Black Money

- Timsy Jaipuria - 21

- Cyber Security:

- Issues and Way Forward

- B M Mehtre - 24

Special Article

- Less-Cash Economy: India vis-avis the world

- Arpita Mukherjee, Tanu M Goyal - 28

- Achieving A Cashless Rural Economy

- Sameera Saurabh - 34

- Digital Transformation :

- Boosting Rural Economy

- Sandip Das - 38

- Demonetisation : A step towards

- Less Cash Economy

- D S Malik - 42

- Payment Systems in India–Driving

- “Less Cash Economy”

- G Raghuraj - 47

- Demonetization , Cashless

- Economyand Development

- B K Pattanaik - 52

When the Prime Minister announced demonetisation of 500 and 1000 rupee notes on the night of 8th November 2016, the first reaction all over the country was one of

stunned disbelief.

The main objective of this move was to curb black money, corruption and fake money menace. With inflation and the cost of commodities going up daily, the 100 rupee and 50 rupee notes had become virtually invisible in the purchase domain. And, the joke going around was that the only two people who would accept 10 rupee notes were god and the beggar! In India demonetisation was undertaken twice in the past, once in 1946 and the second time in 1978. However, during both those times, the Indian economy was not so vibrant. The notes demonetised were of high denominations with very few people having access to these high denomination notes and hence not much hardship was faced by the common man. However, the present demonetisation announcement had widespread repercussions. The 500 and 1000 rupee notes being the most widely circulated denominations, their demonetisation left people with no cash in hand even to purchase daily perishables like bread, milk and eggs, vegetables and fruits. How was fees to be paid, salaries to be given, et al became daily concerns for the common man. The cash crunch in banks and ATMs added to the people’s woes. There was clamor to deposit cash in bank accounts, exchange old notes for new ones, and to withdraw scarce cash from ATMs.

The only fact that actually gave the comman man solace was the stated purpose of the demonetisation i.e unearthing of black money and curbing of terror financing. The Prime Minister, in his speech, had declared that the step would strengthen the hands of the common citizens in the fight against corruption, black money and counterfeit notes. The common man, frustrated by the problems caused by black money economy and also the violent proclivities of terrorist organisations funded

by black money, was glad that some drastic action had been taken to put an end to these activities. Another motive of the government in demonetisation was to create a cashless economy. Cashless transactions have the benefit of transperancy i.e. all transactions can be traced and tracked. This helps the government to track payment to terrorist organizations and other anti-national activities. At the same time, the existing white money of the people remains with banks and also in knowledge of the government facilitating it’s recycling into the system for giving loans to the needy and for development activities.

However, in a country where a large proportion of the population is illiterate and the rural areas have inadequate infrastructure for digital transactions it is not possible to create a totally cashless economy. So, the effort has now been to create a less-cash economy i.e. a system of economy where part of the transactions are in cash and the rest in digital payments. Incentives are being offered to those who make digital payments as also those who make arrangements for accepting payments through digital methods.

One major cause for concern in the less cash economy has, however, been the danger of cyber crimes. While, the digital methods reduce the risks involved in carrying cash, they are prone to cyber security risks. At the same time there are definite solutions to handle cyber crimes. Often it is not the technology that fails but carelessness on the part of the user that results in cyber security hazards. The need, therefore, is to have stricter policies to ensure high cyber security standards and to educate people about precautions they need to take to minimise vulnerability.

Digitisation of the economy has been undertaken in various countries with some being successful and some not very successful. The most successful effort so far, has been in Sweden. How successful it will be in India will depend on how much awareness is created among India’s vast illiterate and semi-literate population, especially in rural areas, who have virtually no or very less access to internet. With effective government policies to deal with cyber security issues and large scale awareness drives to educate people, one can hope to see India become a global player in the digital economy.

Click Here to Download Yojana Magazine February-2017

Courtesy : Yojna Magazine