(HOT) UPSC Current Affairs 2025 PDF

NEW! The Gist (JAN-2026) | E-BOOKS

(Download) UPSC MAIN EXAM : 2024 COMMERCE AND ACCOUNTANCY (Paper 1)

(Download) CS (MAIN) EXAM : 2024 Commerce and Accountancy (Paper 1)

- Exam Name: CS (MAIN) EXAM:2024 Commerce and Accountancy (Paper I)

- Time Allowed : Three Hours

- Marks: 250

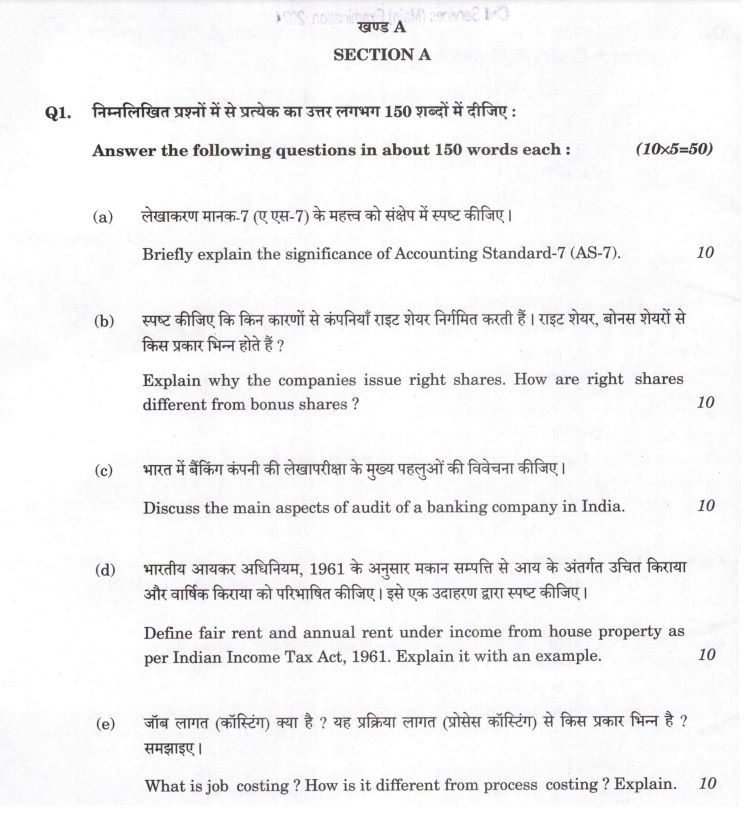

खण A SECTIONA

Q1. Answer the following questions in about 150 words each : (10x5=50)

(a) Briefly explain the significance of Accounting Standard-7 (AS-7).

(b) Explain why the companies issue right shares. How are right shares different from bonus shares?

(c) Discuss the main aspects of audit of a banking company in India.

(d) Define fair rent and annual rent under income from house property as per Indian Income Tax Act, 1961. Explain it with an example.

(e) What is job costing? How is it different from process costing? Explain.

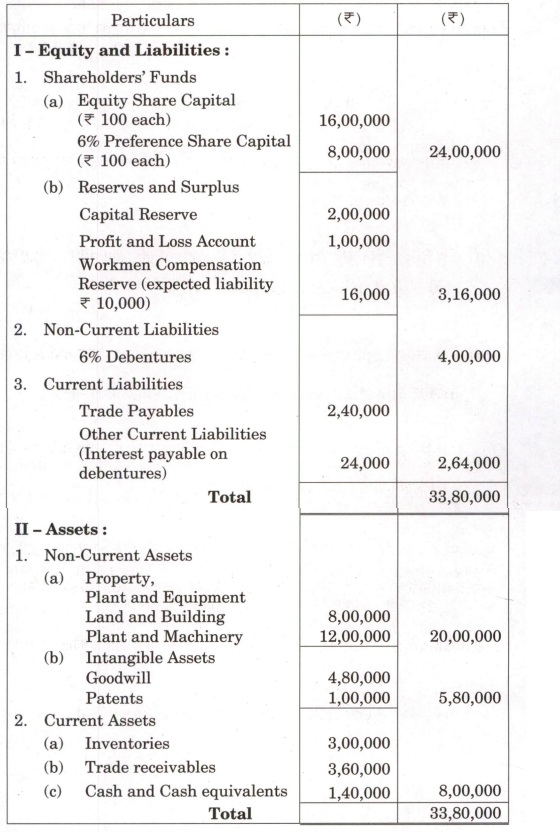

Q2. (a) A Ltd. has acquired the business of B Ltd., whose Balance Sheet as at 31st March, 2024 is as under:

A Ltd. was to take over all assets (except cash) and liabilities (except for interest due on debentures) and to pay the following amounts:

(i) 4,00,000, 7% Debentures ( 100 each) in A Ltd. for the existing debentures in B Ltd.; for the purpose, each debenture of A Ltd. is to be treated as worth 105.

(ii) For each preference share in B Ltd. 10 in cash and 9% preference shares of 100 each in A Ltd.

(iii) For each equity share in B Ltd. 20 in cash and one equity share in A Ltd. of 100 each having market value of 140.

(iv) Expenses of liquidation of B Ltd. are to be reimbursed by A Ltd. to the extent of 20,000. Actual expenses amounted to 25,000.

A Ltd. valued Land and Building at 11,00,000, Plant and Machinery at 13,00,000 and Patents at 40,000 of B Ltd. for the purpose of amalgamation.

Pass necessary journal entries in the books of A Ltd. and B Ltd.

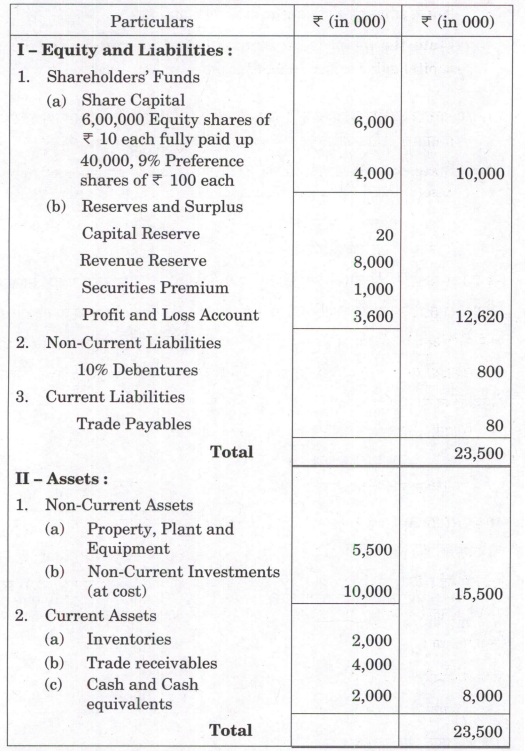

(b) A Ltd. furnishes the following Balance Sheet as at 31st March, 2024 :

The company passed a resolution to buy back 20% of its equity capital @15 per share. For this purpose, it sold its investments of 60 lakhs for 50 lakhs.

You are required to pass necessary journal entries in the books of A Ltd. and prepare Balance Sheet after buyback of shares.

(c) (i) State the methods of computation of Short-term and Long-term capital gains under Indian Income Tax Act, 1961.

(ii) State the rules of capital gains in case of transfer of depreciable assets under Section 50 of the Indian Income Tax Act, 1961.

Q3. (a) During the month of May 2024, total 2000 units were introduced into Process-I. The normal loss was estimated at 5% on input. At the end of the month, 1400 units had been produced and transferred to the next process, 460 units were incomplete and 140 units had been scrapped. It was estimated that incomplete units had reached a stage in production as follows :

Material : 75% completed

Labour : 50% completed

Overheads : 50% completed

The cost of 2000 units introduced was Rs. 5,800. Direct material introduced during the process amounted to Rs. 1,440. Production Overheads incurred were Rs. 1,670 and Direct Labour was Rs. 3,340. Each unit scrapped was realized at 1 each unit. The units scrapped have passed through the process, so were 100% completed as regards material, labour and overheads.

You are requested to prepare the following statements:

(i) Statement of Equivalent Production;

(ii) Statement of Cost and Evaluation;

(iii) Process-I Account ; and

(iv) Abnormal Loss Account.

(b) "Cost Accounting is a system of foresight and not a post-mortem, it turns losses into profits, speeds up activities and eliminates waste." Explain the statement along with your viewpoints.

(c) What are the key differences between Special Audit and Accounts Investigation? Give your viewpoint along with examples.

Q4. (a) Mrs. Y (59 years) receives Rs. 7,90,000 as basic pay and Rs. 1,18,000 as bonus during the previous year 2023 – 24. Besides, she gets Rs. 52,000 as Dearness Allowance (forming part of salary) and 4 percent commission on turnover achieved by her. During the year, turnover achieved by her is Rs. 90 lakh. The employer contributes Rs. 2,24,240 towards recognised provident fund. The amount of interest credited to provident fund on 30 November, 2023 at the rate of 10 percent comes to Rs.40,000. She also gets child education allowance of Rs. 450 per month ( for daughter) and Rs. 80 per month ( for son). Cost of education is approximately Rs. 1,80,000 for two children (out of which Rs. 1,10,000 is tuition fees paid by Mrs. Y). The employer company provides 1800 cc car to her for official and private purpose and incurs the entire expenditure on running and maintenance of the car. Personal use of the car as per log book is approximately 65 percent. With effect from 1 November, 2023, she gets a driver to whom the company pays Rs. 6,000 per month. Her income from house property is Rs. 1,65,000.

During the year she makes the following contributions and investments :

(i) Own contribution towards provident fund Rs.3,36,360.

(ii) Insurance premium on own life Rs.9,000 (sum assured Rs.80,000, policy taken in December 2018).

(iii) Contribution towards NSC VIII issue Rs. 11,000.

(iv) Insurance premium on the life of major son (not dependent on her) Rs.4,000 (sum assured Rs. 1,00,000).

(v) Insurance premium on the life of her mother (age 80 years ) dependent on her Rs.2,000.

(vi) Repayment of loan taken to purchase house property Rs. 21,000. Determine the taxable income of Mrs. Y for the assessment year 2024 – 25 under regular tax regime. Also calculate Gross Qualifying amount under Section 80 C.

(b) What are the conditions required for availing of additional depreciation as per the Indian Income Tax Act, 1961 ? Explain with a detailed example.

(c) Discuss in detail the important checklist points for a smooth and effective audit of non-profit making organisations. How is it different from the audit of modern day business organisations?

खण्ड B SECTION B

Q5. Answer the following questions in about 150 words each : ( 10x5= 50 )

(a) Define corporate restructuring. Differentiate between mergers and acquisitions. Also give suitable examples.

(b) Distinguish between money market and capital market. Explain the present state of RBI policy for the money market.

(c) management. Why wealth-maximization the preferred objective?

(d) "Indian capital markets are sound and well-structured under SEBI's supervision.” Explain this statement.

(e) "Investment decisions are more important than financing and distribution decisions in financial management." Discuss this statement.

Q6. (a) Six years ago, a machine was purchased for Rs. 3,00,000. It has been depreciated to a book value of Rs. 1,80,000. Its economic life was 15 years with no salvage value. If this machine is replaced by a new machine costing Rs. 4,50,000, the operating cost would be reduced by Rs. 60,000 for the next 10 years. The old machine could also be sold for Rs. 10,000. The cost of capital is 10%. The new machine will be depreciated on straight line basis over eight years life with Rs. 50,000 as salvage value.

Assuming the company's tax rate to be 55% and using the NPV method, state whether the old machine should be replaced or not.

The present value factor at 10% is as follows :

Year 1 2 3 4 5 6 7 8

PVF | 0909 | 0-826 | 0-751 | 0-683 | 0-621 | 0-564 | 0513 | 0-467

(b) Discuss the risk-return trade-off in financial decisions. Give examples.

(c) How will you measure the degree of combined leverage? Also describe the effects of combined leverage along with suitable examples.

Q7. (a) The Board of Directors of a company asks to prepare a statement showing working capital estimates for a level of activity of 15,600 units of production. The following information is available for calculation: (A) Per Unit Cost and Selling Price:

Raw materials 90

Labour RS.RS.40

Overheads RS.75

total : 205

Selling Price: 265

Profit :RS.60

(B) (i) Raw materials are in stock on an average for one month.

(ii) Raw materials are in process on an average for two weeks.

(iii) Finished goods are in stock on an average for one month.

(iv) Credit allowed by suppliers - one month.

(v) Credit allowed to debtors - two months.

(vi) Lag in payment of wages 1 weeks.

(vii) Lag in payment of overheads is one month.

20% of the production is sold against cash. Cash in hand is expected to be 60,000. It is to be assumed that production is carried on evenly, throughout the year, wages and overheads accrue similarly and the time period of 4 weeks is equivalent to one month.

(b) A company has earnings of 1,00,000. The capital structure of the company contains debt as well as equity in which debt is of 4,00,000 borrowed at the rate of 10%. Presently, the cost of equity capital of the company is 12.50%. Find out the total value of the company and the overall cost of capital using Net Income approach. If debt is increased or reduced by 1,00,000, what will be the effect on the value of the company and on overall cost of capital as per the Net Income approach?

(c) Discuss the leading financial market instruments and innovative debt instruments in the Indian financial system. Also give suitable examples.

Q8. (a) Explain the key classification of the Indian financial system. Make a diagram that depicts the entire financial system and its key components.

(b) "The insurance industry in India is growing very fast under the direction and control of IRDA." In the light of this statement, discuss the emerging trends in life and health insurance. Also explain the government policy initiatives in this regard.

(c) Define working capital management in a manufacturing firm. What are the key components of working capital? How does inventory management hold importance over cash management in modern business organisations?