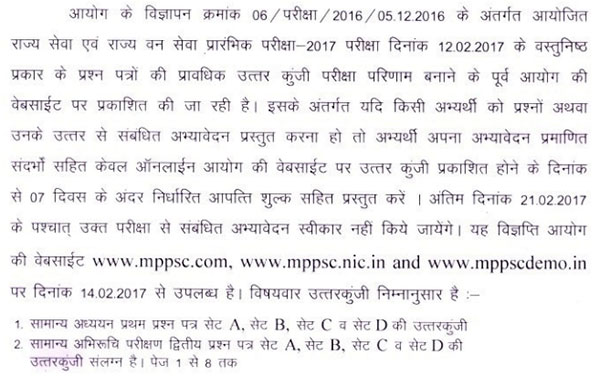

PARA

India is facing the problem of "twin balance sheet problem",

where both the banking and corporate sectors were under stress. Not just a small

amount of stress, but one of the highest degrees of stress in the world. At its

current level, India's NPA ratio is higher than any other major emerging market

(with the exception of Russia), higher even than the peak levels seen in Korea

during the East Asian crisis. Typically, countries with a twin balance sheet

(TBS) problem follow a standard path. Their corporations over-expand during a

boom, leaving them with obligations that they can't repay. So, they default on

their debts, leaving bank balance sheets impaired, as well. This combination

then proves devastating for growth, since the hobbled corporations are reluctant

to invest, while those that remain sound can't invest much either, since fragile

banks are not really in a position to lend to them. This model, however, doesn't

seem to fit India's case. True, India had boomed during the mid-2000s along with

the global economy. But it sailed through the GFC largely unscathed, with only a

brief interruption in growth before it resumed at a rapid rate.

For some years, it seemed possible to regard TBS as a minor

problem, which would largely be resolved as economy recovery took hold. But more

recently it has become clear that this strategy will not work. Growth will not

solve the problems of the stressed firms; to the contrary, the problems of the

stressed firms might actually imperil growth.

To avoid this outcome, a formal agency may be needed to

resolve the large bad debt cases - the same solution the East Asian countries

employed after they were hit by severe TBS problems in the 1990s. In short, the

time may have arrived to create a 'Public Sector Asset Rehabilitation Agency'.

It has now been eight years since the twin balance sheet

problem first materialised, and still no resolution is in sight. And because the

financial position of the stressed debtors is deteriorating, the ultimate cost

to the government and society is rising - not just financially, but also in

terms of foregone economic growth and the risks to future growth.

The Survey shows that our country has been trying to solve

its 'Twin Balance Sheet'(TBS) problem - overleveraged companies and

bad-loan-encumbered banks, a legacy of the boom years around the Global

Financial Crisis. So far, there has been limited success. The problem has

consequently continued to fester: Non-Performing Assets (NPAs) of the banking

system (and especially public sector banks) keep increasing, while credit and

investment keep falling. Now it is time to consider a different approach - a

centralised Public Sector Asset Rehabilitation Agency (PARA) that could take

charge of the largest, most difficult cases, and make politically tough

decisions to reduce debt.

What

is the Act all about?

What

is the Act all about?

What

is it?

What

is it?