(Download) NCERT Book For Class XII : Accountancy 1

(Download) NCERT Book For Class XII : Accountancy I

Table of Contents

- Chapter 1 Accounting for Not-for-Profit Organisation

1.1 Meaning and Characteristics of Not-for-ProfitOrganisation

1.2 Accounting Records of Not-for-Profit Organisations

1.3 Receipt and Payment Account

1.4 Income and Expenditure Account

1.5 Balance Sheet

1.6 Some Peculiar Items

1.7 Income and Expenditure Account based on Trial Balance

1.8 Incidental Trading Activity - Chapter 2 Accounting for Partnership : Basic Concepts

2.1 Nature of Partnership

2.2 Partnership Deed

2.3 Special Aspects of Partnership Accounts

2.4 Maintenance of Capital Accounts of Partners

2.5 Distribution of Profit among Partners

2.6 Guarantee of Profit to a Partner

2.7 Past Adjustments

2.8 Final Accounts - Chapter 3 Reconstitution of a Partnership Firm – Admission of a Partner

3.1 Modes of Reconstitution of a Partnership Firm

3.2 Admission of a New Partner

3.3 New Profit Sharing Ratio

3.4 Sacrificing Ratio

3.5 Goodwill

3.6 Adjustment for Accumulated Profits and Losses

3.7 Revaluation of Assets and Reassessment of Liabilities

3.8 Adjustment of Capitals

3.9 Change in Profit Sharing Ratio among the Existing Partners - Chapter 4 Reconstitution of a Partnership Firm – Retirement/Death of a Partner

4.1 Ascertaining the Amount Due to Retiring/Deceased Partner

4.2 New Profit Sharing Ratio

4.3 Gaining Ratio

4.4 Treatment of Goodwill

4.5 Adjustment for Revaluation of Assets and Liabilities

4.6 Adjustment of Accumulated Profits and Losses

4.7 Disposal of Amount Due to Retiring Partner

4.8 Adjustment of Partner’s Capital

4.9 Death of a Partner - Chapter 5 Dissolution of Partnership Firm

5.1 Dissolution of Partnership

5.2 Dissolution of a Firm

5.3 Settlement of Accounts

5.4 Accounting Treatment

Printed Study Material for IAS Pre General Studies (Paper-1)

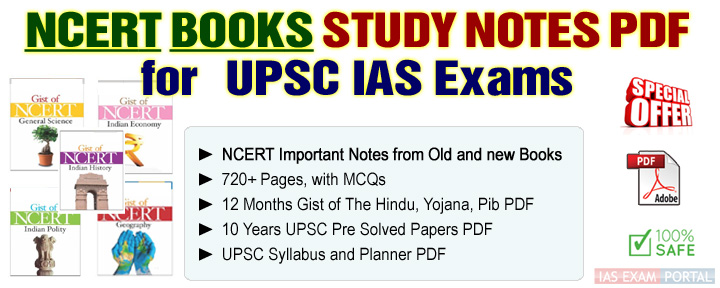

Get Gist of NCERT Books Study Kit for UPSC Exams

Printed Study Material for IAS Pre Exam

Go Back To NCERT Books Main Page

Courtesy : NCERT